Introduction

I have read with keen interest several rejoinders on this issue of debt relief, particularly in reference to my earlier intervention.

http://nigerianmuse.com/essays/?u=Debt_relief_Nigeria_emit.htm

MONDAY QUARTER-BACKING: Debt Relief and Nigeria - To Emit or not to Emit $12 billion

I have even compiled a few of the rejoinders in :

http://nigerianmuse.com/opessays/?u=reactions_to_debt_relief_essay.htm

One set of arguments centers on the (un)realistic spread to be expected between the reduced interest rate that we might/should be able to negotiate with Paris Club and what we might earn if we invested $12 billion on our own, rather than emit it to Paris Club members over a one-year period. Another salient point is a reminder of Clinton's commonsensical dictum that "managing the national economy is no different from managing one's personal or family finances. The only difference is in the size of the national economy vis a vis its household counterpart ", with the question of what one would do if one in his own household if that household were Nigeria. The third salient point has to do with uncertainties about 2007 and beyond.

Interest Rate Spread

If one takes a peek at all the principal repayment profiles listed in the Naples terms,

http://www.clubdeparis.org/en/presentation/presentation.php?BATCH=B06WP01

Standard Table A1 - principal repayment profile [Debt Reduction DR option; 6 year grace; 23 year repayment]

http://www.clubdeparis.org/en/presentation/presentation.php?BATCH=B06WP02

Standard Table A3 - principal repayment profile [Debt Service Reduction DSR option; 33 year repayment, reduced interest rate]

http://www.clubdeparis.org/en/presentation/presentation.php?BATCH=B06WP03

Standard Table A5 - principal repayment profile [Debt Service Reduction DSR option;stock treatment]

one sees graduated interest rates hovering in the 7-8% (very last stage of payment of Table A1] or 4-5% .

If we eschew any grace period, and the complications of graduated semester-adjusted interest rates, it should be POSSIBLE for Nigeria to negotiate a FIXED reduced interest rate of between 3% - 4%.

Having obtained a 3-4% reduced interest rate, our $12-15 billion INVESTED by ourselves - at 6% ? 10% ? 15% ? 20% ? - rate of return over anywhere from a 10- to 20-year period should then be able to pay up on interest and some principal if and when due.

The important thing here is that at the end of our payment period, we still have our $12 billion back plus some, rather than having emitted it several years back. Besides, we will be paying up our loans from this set-aside money, not from the traditional budget pool the amount of which debt service payment we keep comparing with what we spend on education, health, agriculture, etc.

In closing out this section, we must note here that NONE of the five standard Naples options (DR, DSR, CMI, "commercial options" or debt swaps) outlined under "Description" in

http://www.clubdeparis.org/en/presentation/presentation.php?BATCH=B02WP06

Naples Terms

talks of "payment of arrears" and/or emission of large sums to qualify. Of all the 44 countries that have been treated (10 treated) or are being treated (34 active) on the Naples terms, not one has had to pay arrears or emit - at least that has not been stated anywhere.

See

http://www.clubdeparis.org/en/countries/countries.php?TYPE_TRT=NA .

List of the countries that have benefited from Naples terms

Therefore, these conditions must have been either at the suggestion of Nigeria (which Paris Club jumped at) or were an "extortionary" condition of that cartel who were eyeing our "exceptional revenues" for themselves.

Clinton's Nation-as-Family

As to the Clinton "nation-as-family" doctrine of finance, if we must push that anthromorphy, then we might as well push it to the limit., For example, I can only quote a short piece of what I read in the Guardian today, viz:

QUOTE

.....Responding to the fact that Nigeria is paying $12 billion to the Paris Club, Onyekpere queried whether this is the best thing that Nigeria could do with her resources.

His words: "Nigeria is behaving like a father or guardian who starves his children. When they are sick, they don't get correct medical attention, they are sent out from school because they can't pay the fees, but at the end of the year, the father calls his wife and the children and say, lets celebrate, we have saved so much these years. How do you think the children would react? Is it not with annoyance?"

"We have been piling up this money while neglecting our roads, schools, electricity. So this piled-up money make our creditors to believe that we have so much money, therefore the negotiation is wrong," he said.

UNQUOTE

It is this artificial "exception revenues" that both Nigeria and the Paris Club are salivating about.

Besides, on this debt issue, my mortgage company, car note company, Sears charge, credit card holders don't GANG up on me in a cartel (like the Paris Club) and decide AMONG themselves how to divvy up what I am prepared to pay. Rather, if I suddenly had a large amount of cash in my hands, I would tally up my debts based on three things:

1. how much I owe each creditor (I''ll group-rank from lowest to highest);

2. how much interest rate I am paying to each creditor (I'll group-rank from highest to lowest);

3. how much I detest each creditor, either because he bothers me too much to pay up, or is always trying some tricks to add on to my debt, or I got the loan from him at a time when I was desperate even though I don't like him a bit etc. (I'll group-rank from most disliked to least disliked or from least tolerant to least tolerant)

I would be prepared to pay down some or ALL of my debt depending on the group ranking (the higher the rank, the more likely I will pay), negotiate with some of them for interest reduction in exchange for some lump payments, but not necessarily pay off ALL of my debt even if I had the money to since I may turn around to get loans again from some of these same people - for college for kids, a business venture that I had always wanted to start, etc. !

Paris Club DOES not allow for such disaggregation between their members, otherwise, Nigeria could have paid off HALF of the 15 countries that we owe money to, so that we can be beholden to FEWER countries.

So even if I have ENOUGH money to PAY OFF ALL OF MY DEBT, nothing says that I should pay them right off right away.

2007 and Uncertainty of Succession

What I quoted above (by Onyekpere) is part of a larger write-up, more of which I now quote:

QUOTE

Sunday, August 28, 2005

A debt reprieve without relief

By Bukky Olajide

FINANCIAL experts, after a deeper look at the recent debt relief offer from the Paris Club of Creditors concurred that a raw deal has manifestly been negotiated for the country.

The experts, in separate chats with The Guardian, explained that depletion of the country's resources by $12 billion has little relationship with prudent economic management, based on the situational factors on the ground.

....Adedipe said that "the way the Paris Club structured it is that they see us realising a lot of revenues from the sales of crude oil far in excess of what is budgeted for."

Historically, he said, "we have been spending everything until recently when instead of spending the excess, we made it accrued to build a reserve coupled with an account dedicated to the excess revenue."

He said: "Therefore, looking at those things, Nigeria suddenly finds itself having about $30 billion between reserve and excess revenue. And so it became quite attractive to our creditors that if you have this much, why don't we take advantage of that now, make an offer to you. Why don't you pay $12 billion now and then we can write off the remaining $18 billion. That looks sensible. It will appear as a good offer from Paris Club," he said.

Subjecting it to analysis, Adedipe said that $12 billion invested now with a minimum of five per cent interest per annum in 18 years will bring $28 billion.

"So that means that if I invest now what I would get as return would be almost double, equal to what I am supposed to be asking of as debt. So we can actually look at that $12 billion as the future value of what Nigeria is owing now," he said.

Disproving some peoples' opinion that Nigeria will no longer need to service again, therefore we will be able to save $1 billion every year, Adedipe said that one can't save what he has not earned.

He said: "When you talk of savings, savings come from your previous earning in which case, you saved from earnings, therefore saving is generated out of purpose that comes from the past. You can't save based on what is coming in the future."

"So, proposing that Nigeria is going to save this much over that period does not make economic sense in any way. In fact, it's a financial aberration to talk of savings that you claimed to have made when you have not formally repudiated the loan," he said.

Going further, the research economist said that, of course, these multilateral agencies connected their claim with the political side.

To them, 2007 is coming and who knows the kind of a person that assumes presidency will be, what will be the kind of fiscal discipline the person will have, would he still behave like the current government that saved. Perhaps, they think it is better for them now that Nigeria has much money to take their own money and get out of this relationship.

UNQUOTE

It is this simplistic reasoning - lack of confidence in succession after 2007 - that is really the bottom line to the administration's argument, even if it will not be publicly admitted.

Conclusion

Finally, although many of them are keeping quiet now, I can predict that if and when we emit the $12 billion, Nigeria, Nigerians and the world will be INUNDATED by econometric analyses FROM THESE SAME Paris Club PEOPLE who are asking for our money now. They would then be telling us what THEY would have done DIFFERENTLY if they were in our shoes. Then they would make us look like fools all over again.

At least some of us would have said that we told you so.

I rest my case for now.

RETURN

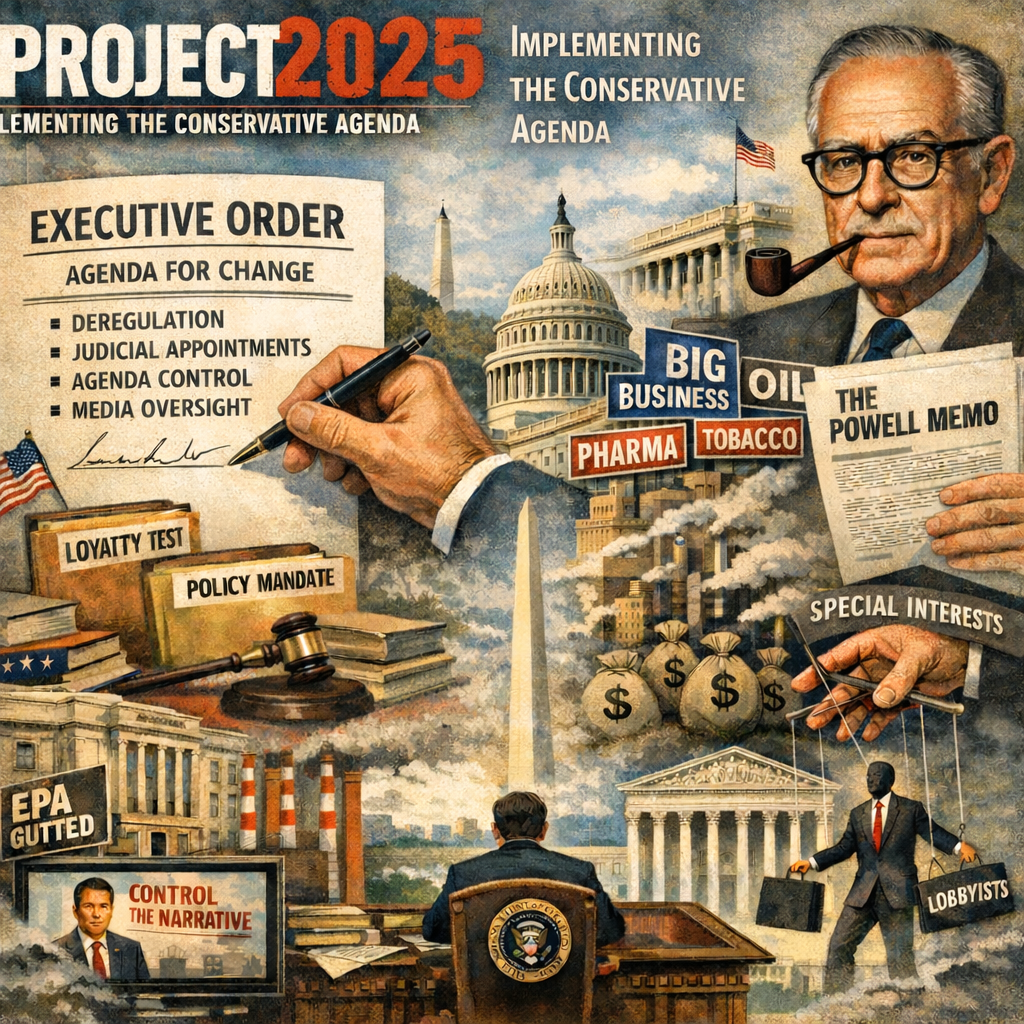

From the Powell Memo to Project 2025: How a 1971 Corporate Strategy Became a Global Template for Power In August 1971, a corporate lawyer named L...

The Market’s Mood Ring: How Volatility Across Assets Traces a Hidden Geometry of SentimentIf you want a fast, honest way to describe modern markets,...

Nigeria’s grid collapses are not ‘bad luck’ – They are a design failure, and we know how to fix themFirst published in VANGUARD on February 3,...

Islands of Credibility: Nigeria’s Best Reform Strategy Starts in the StatesFirst published in VANGUARD on January 31, 2026 https://www.vanguard...

Project 2025 Agenda and Healthcare in NigeriaThe US and Nigeria signed a five-year $5.1B Memorandum of Understanding (MoU) on December 19, 2025, to bo...