Introduction - Mixing Oil & Water

Biting fuel scarcity recently returned to our land called Nigeria! I saw two-mile long queues with my own eyes within the past fortnight week, including just a week ago as I travelled from Akure to Abuja. Petrol cost as “low” as N40 per liter in the South, and as high as N100-N150 per liter, particularly in the North. Until about a fortnight ago, it cost N26 per liter (control price; that is about N100 per US gallon, or 79 US cents per gallon at $1 to N127, or 86 US cents at N116) of Premium Motor Spirit (PMS, or petrol) everywhere in Nigeria.

Mind you, in Akure, a carton of twelve 150-cL bottles of Ragolis Table pure water costs N650, and N850 in Abuja. That is N36 per liter in Akure, and N47 in Abuja.

So, finally, the cost of refined oil is catching up with the cost of processed water in Nigeria, and a regional DIFFERENTIAL in pricing is also occurring.

Those are interesting developments which should hardly be surprising.

The Economics of Oil

Nigeria produces roughly 2 million barrels of crude oil per day. With Nigeria’s Forcados crude at roughly 7.22 metric tons per barrel and Bonny Light at 7.49 metric tons per barrel, that translates to roughly 14.5-15 million metric tons per day.

Nigeria’s total consumption need, on a daily basis, is about 0.4 million barrels per day of crude, which translates roughly to 38 million liters of refined products [petrol or gasoline (PMS), kerosene (DPK Dual purpose kerosene) and diesel (AGO)], of which 14 million liters is PMS. Consequently, the total installed capacity of 0.445 million barrels per day of our four refineries [Kaduna (0.110 mmbpd capacity), Warri (0.125 million mmbpd) and two in Port Harcourt (.060 mmbpd, 0.150 mmbpd)] would have fully satisfied our domestic needs, and still leave a 10% surplus. However, due to technical inefficiencies, political incompetence and leadership failures over the years, all the refineries have only been able to perform, even at peak form, at 40-60% of total installed capacity, or at 0% (total shut-down) at other times, like a fortnight ago when both Port Harcourt refineries suddenly had to shut down. (They have since resumed production, we hear.)

Obviously, to meet local demand for refined products, whatever is not refined locally has to be imported from external sources.

And that is where the paradoxical problem is - Africa’s largest crude producer, OPEC’s sixth largest and the world’s tenth importing as much as 40-60% of its refined product!

In early 2002, according to news reports, the cost of a barrel of Nigerian oil was roughly $20 per barrel (N2,320 per barrel at $1 to N116), at a time when a metric ton of refined oil was about $178.25. Soon after, it increased to $25 per barrel (a 25% increase), with refined products tracking it about $202 per metric ton (13.2% increase). Crude oil price has doubled in the past few weeks to almost $40 per barrel due to fears of a new Iraq/US war, reported oil stockpiling in the US (presumably hedging against unusually cold winter this year), and the lingering Venezuela political crisis. One would not be surprised if the price of refined products increases soon to $270 per metric ton.

Today, the Naira exchanges via the Dutch Auction System (DAS) at about $1 to N127. $270 per metric ton would translate to N34,290 per metric ton, up from N20,677 when it was $178.25 per ton at N116 to the dollar, a 66% increase!

The Politics of Petrol

Three things recommend president Obasanjo to Nigerians for continuance in office after April 2003 - or so his operatives say:

the return of acceptability of Nigeria to the comity of nations;

the termination of long petrol lines (due to scarcity) from our roads;

GSM.

If one leg of the tripod - Tripod Leg # 2 in this case - crumbles, the whole pack of recommendations is in trouble. Our international “corruption index” (including “419”) continues to threaten Tripod Leg # 1 abroad, and the sheer cost and poor Quality-of-Service of GSM threatens Tripod Leg # 3 at home.

And we are not including personal insecurity, including political assassinations, the latest being in Abuja: that of ANPP’s chieftain, Dr. Marshall Harry from the oil-city of Port Harcourt.

Jerry Gana, the voluble Information Minister of Obasanjo regime, has hinted darkly - and preposterously too - that some “evil forces” are trying to bring the government down with the new fuel scarcity. That is an odd-ball charge. Without agreeing publicly - and despite the presence of Petroleum Pricing and Products Regulatory Committee (PPPRC) Chairman Rasheed Gbadamosi’s oil panel - President Obasanjo has instituted a 7-man panel - oddly headed by His Eminence the Obi of Onitsha himself - to investigate the causes of the scarcity. One expects the panel to come out to stamp its approval on Gana’s statement.

In the meantime, to render the case moot, Obasanjo says that he has ordered the immediate importation of 500 million liters of oil to relieve the scarcity pressure, and that “a smile would be put on the faces” of Nigerians by this past week-end. Assuming that on average a car fills up with 50 to 60 liters, that is 10 million cars - mostly gas-guzzling “T’okun-bohs” or T’osa-dehs” - will be filled soon in Nigeria. Since it takes roughly N35 per liter to import the oil, and N9 to subsidize it (so that it sells at N26), that would be a nice way to spend N17.5 billion right away up front, and N4.5 billion in subsidy.

This is the political season, with elections must around the corner.

The Funny Business at NNPC

The Nigerian National Petroleum Corporation NNPC is the government-owned giant that controls Nigeria’s oil industry, and is in charge of the four Nigerian refineries. Somehow it is backed by some inscrutable law to buy 0.445 million barrels per day of domestic crude - which is exactly how much all the refineries would refine at full capacity. This privilege is irrespective of the actual capacity used up by the refineries. It has another privilege - to buy at a discounted rate of $18 per barrel, no matter the international price of crude. A third privilege puts icing on the cake: to sell what it does not use up at the refineries at the prevailing WORLD MARKET PRICE!

I think that you get the picture: Suppose the fraction of the amount of the domestic crude that NNPC does not refine is y. If it had refined this amount and sold it at a domestic price of N26 per liter, it would have earned $ 38 crude/0.4 refined * 26 refined/127 exchange or $ 19.4 per barrel of crude refined. [0.4 million barrels of crude approximately equals 38 million liters of refined product; control refined price of N26 per liter is assumed.] If the current international market crude price is for example $28 per barrel, NNPC will make a cool profit of 0.445y(28 - 19.4) million dollars or $3.83y million for itself if the government does not ask for that profit back. At $1 to just N127 (for example), that translates to N486y million per day. Over a 364 day per year period, at half-capacity, NNPC would make N88.5 billion profit without the technical hassles and dangers of refining, thereby making the NNPC accountants happy.

This profit to NNPC “improves” as NNPC gets lazier (y increases), the Naira weakens (N127 becomes N130 becomes N150 to the dollar), and/or the cost of oil in the international market escalates ($28 becomes $35 becomes $40 per barrel). What would a “normal” person do in NNPC’s shoes?

Thus by not refining a fraction y of its domestic crude, and being allowed to sell it at the prevailing international market, NNPC makes a direct gain of N486 y million per day on crude sales, but the nation takes an overall HUGE LOSS of N1,582y million on a daily basis (N290 billion per year for half-capacity all year round), a loss which increases with increasing non-refining. [All the assumptions that go into these calculations should be remembered.]

Thereby inefficiency is rewarded in one sense, but the whole nation suffers as a result.

There you go! No wonder the NNPC was recently accused by the Revenue Mobilisation and Fiscal Allocation Commission (RMFAC) of “missing” N300 billion due to inappropriate accounting for crude oil sales!

So what is to be done?

Whether we like it or not, one of these days, we will still have to bite the bullet: provided we continue to import 40-60% of our needed fuel, we will have to pay the economic price of the refined fuel - whatever the international market conditions of the moment demands. It does not matter how much our crude costs per barrel, or how much of it we have welling up from our land: provided we import so much refined fuel, we will have to pay, sometimes through our noses, the added-value cost of refining.

We need to reduce our own dependence on crude oil by fostering mass transportation (reliable rail and bus services) within and between our major cities. That means huge public/private partnership investments on rail and road infrastructure. Innovative uses for our abundant natural gas for transportation and domestic fuel uses are also called for.

A tighter leash must be put on the current operations of NNPC, many of which are a carry-over from military days when NNPC was a secret cash-cow for the “over-lords.” Certainly, its inefficiency in the refining business should not be rewarded as described above. Either it buys its domestic crude at international market prices (not a reasonable option, I admit), or preferably it is prevented from selling its unused oil in the world market. Otherwise, it will continue to use the eye-popping profits from its operations to have the choicest real estate in Abuja; give its workers the greatest salaries; have its executives travel the world style in swankiest style; and operate secret accounts around the world that it gets defensive over when questions are asked.

We must set loose the chemical engineers and mechanical engineers of our country to do the Turn-Around Maintenance (TAM) of our refineries that we routinely contract to foreign companies, so that they all can operate optimally. Operating a refinery is not rocket-science. The same modus operandi of tasking our indigenous engineers to solve our iron-and-steel problem, the cement problem, the pulp-and-paper problem and other problems should be adopted.

An economic analysis should be done once and for all - focusing on Port Harcourt, Maiduguri, Sokoto, Ilorin and Lagos for example as cardinal points of the country - to determine whether it is more economical to pipe/otherwise transport crude or refined oil to these parts.

Subsidies due to regional cost differentials must not be to EQUALIZE absolute costs, but to possibly equalize percentage contributions to the differentials due to transportation and other costs.

I envisage that about eight to ten private mini- to midi-refineries - of the order of 10-30,000 barrels per day strategically located around the country, with the realistic optimum of 75% - 90% capacity utilization of ALL the refineries will fulfill all of our national needs for the foreseeable future. The licensing process of private refineries should be simplified, and the cost barrier to entry significantly lowered.

Have a good week.

horizontal rule

Oil Gravimetrics

bullet I barrel = 42 US gal = 0.159 m3 = 159 liters

bullet 1 metric ton = 1000 kg

bullet Density of water = 1 metric ton / m3 = 0.159 metric ton / barrel = 0.001 metric ton / liter

bullet Specific gravity SG = density of material / density of water

bullet API of Crude = (141.5 / SG ) - 131.5

bullet API (Forcados) = 31; API (Bonny Light) = 37

bullet SG (Forcados) = 0.871; SG (Bonny Light) = 0.840

bullet SG (Gasoline, average) = 0.73; SG (Kerosene, average) = 0.80

bullet SG (Diesel, average) = 0.84

For some oil prices, see:

Crude Oil Futures Prices - NYMEX

Crude Oil Spot Prices

Brent as a world benchmark

Major Nigerian Oil Production Joint-Ventures

horizontal rule

For companion articles, see:

A ThisDay Article

Deregulation: Petrol May Sell for N31

THISDAY Board of Economists - By Ijeoma Nwogwugwu

Were the Federal Government to deregulate the downstream sub-sector of the petroleum industry today and pave way for major and independent oil marketers to import fuel into the country, it is very likely that petrol would be sold at a pump price of N31.00 per litre. This figure was arrived at by THISDAY Economic Intelligence Unit based on extensive discussions with oil marketers in the country and analyses of the Platt's prices for refined petrol.

The marketers, who spoke on the issue, agreed that the Nigerian National Petroleum Corporation (NNPC) and its marketing and distribution subsidiary - Pipelines Products Marketing Company (PPMC) were corrupt and inefficient. They also say that both incurred all sorts of unnecessary charges, which have cost the nation considerable losses.

Giving a breakdown of how oil marketers would arrive at the cost of petrol if they were to import petrol, THISDAY Economic Intel-ligence Unit discovered that based on the limit for yesterday's price quotation, (using Platt's oilgram) for unleaded premium gasoline, Cost Insurance and Freight (CIF) Lagos, was $275.00 per metric tonne. In other words, the cost of freighting petrol from essentially Europe-based or Rotterdam prices to the Lagos, Port Harcourt and Calabar ports is $275.00/mt.

Nigeria Ports Authority charges, translates to about $7.00/mt, thereby bringing the total cost of freighting and discharging into PPMC and oil marketers' depots to $282.00/mt. However since oil marketers importing petroleum products are expected to open letters of credit and source their foreign exchange from the inter-bank forex market, it, therefore, means that at the prevaling official exchange rate of N116 to $1.00, the $282.00/mt will approximate N32, 712.00/mt.

In addition, since 1,341 litres of petrol is equivalent to 1 metric tonne of petrol, the landing cost of each litre of fuel would amount to N24.29 kobo per litre. However, with a government tax of N3.10/litre, dealer's margin of N0.60/litre and a marketer's margin of N2.60/litre, the pump price of petrol would come to N30.69/litre (approximately N31.00/litre), taking into consideration bridging and other associated costs.

The price could be lower if the government waives its taxes and limits itself to the issue of petroleum equalisation charges which can be built into marketers' margin to allow them sell at the same price in Sokoto, Port Harcourt or Lagos. The probable price is a lot cheaper than the N37.25/ litre arrived at by the special committee set up by the Federal Government to review petroleum products supply and distribution in the country.

The committee, THISDAY Economic Intelligence learnt, based its calculations on the inclusion of charges, like demurrage, through-put and bridging, which many marketers said are incurred as a result of the inefficiency and corrupt practices of NNPC/PPMC. Such charges, the marketers averred, would not be incurred under a deregulated regime because importers would bring in fuel in an efficient and prompt manner to maximise their returns.

The scenario painted by the marketers can only obtain if the exchange rate of the naira to the US dollar remains unchanged at the current exchange rate. If, on the other hand, the naira continues with its slide against the dollar and depreciates to N120.00, say, the pump price of petrol may be N31.53 kobo/litre. At N125.00 to the dollar, petrol could cost N32.58 kobo/litre. Worse still, if the exchange rate rises to N150.00 the price of petrol would increase correspondingly to N37.84 kobo/litre! These projections are all based on Platt's prices - which are subject to fluctuations.

Yesterday's price, for instance, has being one of the highest this year, market analysts say. Based on this, THISDAY Economic Intelligence Unit observed that the onus would now be on the Federal Government to implement policies that can bring about exchange rate stability as against release of funds into the economy. Besides, under deregulation, the profit margin of marketers, dealers and transporters are expected to fluctuate and also to be determined by the forces of demand and supply. The implication of this is that competition in the sector would drive down even the margins to be made by operators in the industry.

THISDAY Economic Intelligence Unit also discovered that NNPC's and PPMC's inefficiency and subsidies are costing the Federal Government in excess of $2 billion per annum a whopping sum that can be put to better use in more productive sectors of the economy to better the lot of Nigerians. Using the present fuel shortage as an example, many marketers blamed the current spate of shortages on the Group Managing Director of NNPC, Mr Jackson Gaius-Obaseki and President Olusegun Obasanjo, who oversees the petroleum resources portfolio. Both, they said, have not been able to manage the downstream sector properly. Marketers even went as far as accusing the NNPC of awarding the contract for importation of petroleum products to a Swiss-based commodity trader, Marc Rich just because his bid was far lower than others. Rich, according to sources, was awarded the contract after he submitted a quotation that was 30 cent lesser than nine quotations submitted by other importers. Having secured the contract, Rich discovered that his bid was actually below the prevailing market price and as such could not deliver as that would see him operating at a loss. It is his failure to bring in fuel that has resulted in the current shortage.

RETURN

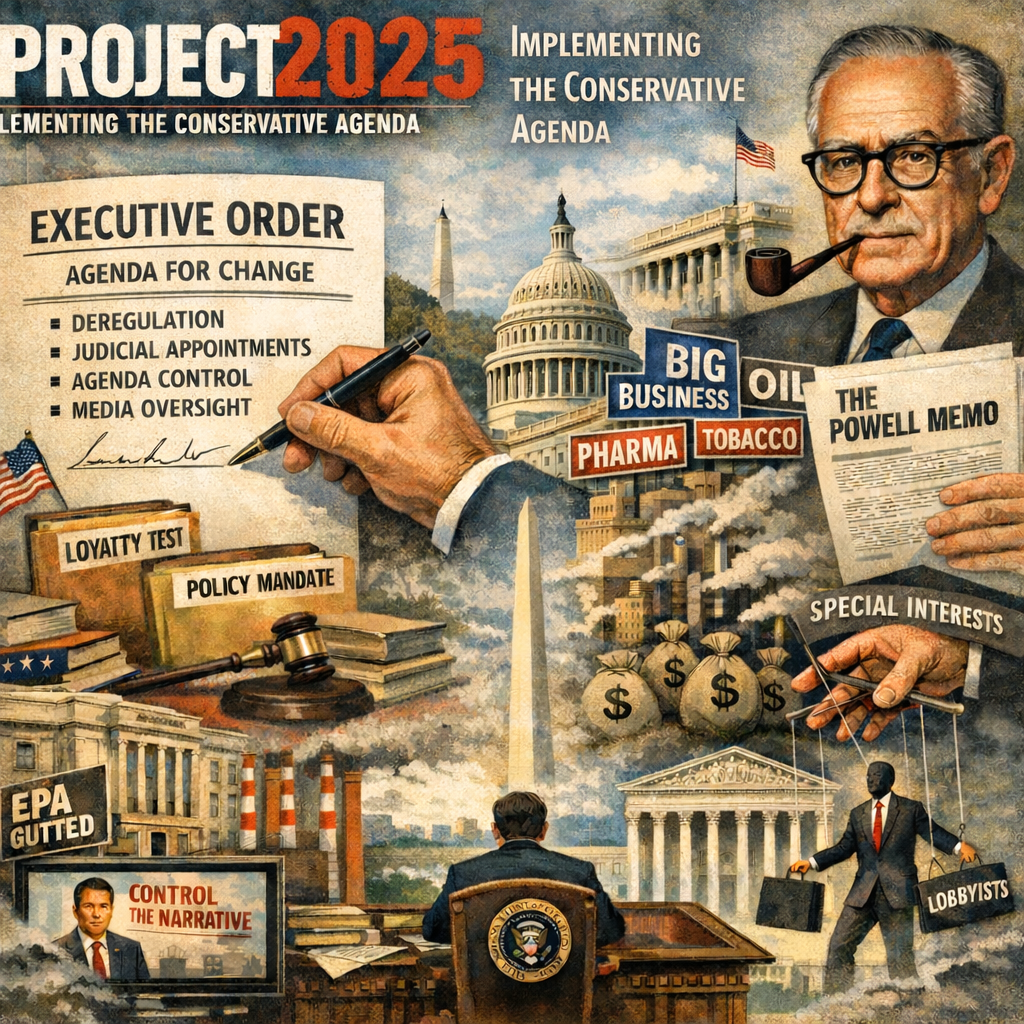

From the Powell Memo to Project 2025: How a 1971 Corporate Strategy Became a Global Template for Power In August 1971, a corporate lawyer named L...

The Market’s Mood Ring: How Volatility Across Assets Traces a Hidden Geometry of SentimentIf you want a fast, honest way to describe modern markets,...

Nigeria’s grid collapses are not ‘bad luck’ – They are a design failure, and we know how to fix themFirst published in VANGUARD on February 3,...

Islands of Credibility: Nigeria’s Best Reform Strategy Starts in the StatesFirst published in VANGUARD on January 31, 2026 https://www.vanguard...

Project 2025 Agenda and Healthcare in NigeriaThe US and Nigeria signed a five-year $5.1B Memorandum of Understanding (MoU) on December 19, 2025, to bo...