INTRODUCTION

I know obfuscation and disingenuity when I see them, and I see them CLEARLY in the admitted N50 million gift of the Central Bank of Nigeria – possibly in cash – to the Senate and House Committees on Banking during its recent consideration of certain reform bills – namely the CBN Act and the Banks and Other Financial Institutions Act (BOFIA).

The Central Bank Governor is Prof. Charles Soludo, the Senate Committee chair on Banking, Insurance and Financial Institutions is Senator Zik Sunday Ambuno (Vice-Chair: Farouk Bello), and that of the House is Honorable Modibo Ahmed (Vice-Chair: U.S.A. Igwesi)

Any attempt by Soludo, the Committee chairmen and their handlers to pull wool over the eyes of Nigerian citizens, to bamboozle us that this was just routine “corporate responsibility services” , aka public relations, must be resisted with fury, because first, we are NO FOOLS, and secondly, public money does NOT belong to them to be used any how and with impunity.

Aha ! What kind of nonsense is that ?

THE INITIAL STORY

Here is how the story first played, first by Punch newspaper of Tuesday, April 5, 2005, and expanded upon by Guardian:

BIG QUOTE

http://www.vanguardngr.com/articles/2002/cover/april05/05042005/f205042005.html

Senator Sunday had in a letter dated November 15, 2005 to Prof. Charles Soludo, CBN Governor, said in part:

QUOTE

“You may recall our discussion on the huge task before the committee relating to the two Acts mentioned. Already, the committee has incurred heavy expenditure on adverts for the public hearings. There is also a need to hire experts, consultants and lawyers as we undertake detail consideration of the two bills. In this regard, any support from the CBN will highly be appreciated, as it will go a long way in assisting the committee to do a good job.”

UNQUOTE

The CBN had on December 17 approved the request with an approval of N50 million to the Senate and House Committees on Banking.

The Senate Committee was to receive N20 million while the House Committee was to receive N30 million. Payment vouchers from the CBN on the approvals entitled as “Donations” were equally approved on the same day.

"I contacted the signatory of the letter, that is Senator Zik Sunday and he categorically informed me that actually, the letter emanated from them but what they were soliciting was not cash, that they were not asking the Central Bank to give them cash, but to give them any logistics support in terms of lawyers and consultants that could help package the whole thing,” Senator Wada told Vanguard yesterday.

Affirming that there was no exchange of cash in the transaction, Senator Wada said: “The truth of the matter is that no such money exchanged hands, they didn’t receive any thing.”

BIG UNQUOTE

In support of its donation to the CBN, an official of the apex bank stated that:

QUOTE

http://www.thisdayonline.com/nview.php?id=14003

The apex bank it has spent over N300 million in various capacity building projects in some Nigerian universities and other government agencies between 1999 and 2004 but decided early this year to stop such projects because of its dwindling fortunes.

“There are hardly any other professional organisations and institutions that promote economic development, monetary and financial policies that have not received donations from CBN,” the statement said.

UNQUOTE

For the Bank to equate donation of money to the National Assembly that was considering certain bills in which the bank had interest to donations to universities , other government agencies and professional organizations and institutions is most dishonest, period. Even a direct donation to the EFCC or ICPC – who could be possible interrogators of the CBN – at a period immediately following the commencement of investigations of the CBN would not pass the smell test.

Yes, on its website (see http://www.cenbank.org/cbncommunity/index.htm ) the CBN lists donations to all twenty-four federal universities (totaling N406.75 million), to the EFCC (N60.5 million) and to the Investments and Securities Tribunal (N10 million) – but not to National Assembly o !

SOME CURIOUS ASPECTS

But there are a number of curious aspects to the exchange between the National Assembly and the Central Bank:

Senator Zik first denied that any money was exchanged – that CBN paid directly for consultants etc. That assertion has since been denied.

There is an allegation that the Senate Committee indicated that since it did not have a bank account separate from the Senate, the money it was asking for should be given to it IN CASH. How the money was actually exchanged is yet to be confirmed – or denied – but to give the money in cash would have been most irresponsible and definitely sanctionable.

The Senate had passed, in August 2004, amendments to the CBN Act and to BOFIA that were NOT in consonance with the desires of CBN, namely:

QUOTE

http://news.biafranigeriaworld.com/archive/2004/aug/27/039.html

THE Senate yesterday [AUGUST 26, 2004] with near unanimity pushed through amendments to the Central Bank of Nigeria Act and the Banks and other Financial Institutions Act (BOFIA) which seeks to reverse the recent CBN guidelines prescribing a minimum N25 billion for the country's banks. The two bills sponsored by three members of the Senate Committee on Banking, Insurance and Financial Institutions were applauded by senators as a necessary check against perceived determination of the CBN to destablise the financial system through its prescription of the N25 million capital base……Under the bill amending BOFIA, banks would be categorized as small, medium and mega banks with paid-up capital at N5 billion, N10 billion and N25 billion respectively…..

The amendment bill also aims to subject the appointment of the CBN Governor to Senate confirmation and compel the regulatory bank to submit periodic analysis of the economy to the Senate and the House of Representatives…..

UNQUOTE

This passage ran counter to Soludo’s July 6, 2004 address to banks’ top brass which pegged the minimum capitalization for deposit taking banks at N25 billion, with December 31, 2005, as the deadline for compliance; or the current situation where the president the CBN governor without need for National Assembly assent.

Consequently, money being asked for in December 2004 was possibly for “quid pro quo” to change the minds of the Senators – if the money reached all of them accordingly. Since the House has not passed its own version of the two bills, they are still “live”, and considerations for them are still pertinent, if you understand what that means.

WHAT IS TO BE DONE ?

So what must be done ?

A. The Senate has started on the right tack, first by noting some impropriety, and next by quizzing Senator Zik Ambuno and by outlining some of what he should do, viz:

QUOTE

Meanwhile, the Senate, at an executive session last Wednesday [APRIL 6, 2005], barred senators from further seeking any sort of "donations or assistance" from ministries, parastatals or the private sector, directing each of the 53 standing committees to work within the budget allocated to it.

The Senate decision, THISDAY gathered, was the outcome of its quizzing of the Senate Committee on Banking, Insurance and other Financial Institutions chairman, Senator Zik-Sunday Ambuno, during executive session, over his committee's alleged demand of N50m donation from the CBN.

According to a Senator, who participated in the executive session, "we have resolved that henceforth no senator should seek any form of donation or assistance from any ministry, parastatals or the private sector. Every committee should also work within the ambit of the budget allocated to it (committee).

"We also put the banking committee chairman, Ambuno, on the spot and asked him to explain to the whole house what his roles are in the said "donation" to enable the Senate receive a first hand information.

"He (Ambuno) admitted writing the letter seeking assistance from the CBN” the source said.

However, what we have done is to discuss the matter and ensure that it does not hit us like a flash as did the on-going N55m bribe-for-budget scam.

"What could be called the high point of the floor was that Ambuno should come forward with facts and figures on how the donation was spent on hiring consultants, holding public hearing and producing the amended Central Bank of Nigeria (CBN) Act as well as the Banks and Other Financial Institutions (BOFI) Act but the matter is yet to be concluded.

"This high point was arrived at on the basis of CBN admission that they approved the N50m donation from which the Senate Committee received N20m and that the CBN offers such assistance once a while. Also, the letter Ambuno sent to CBN was on his letter head so it could not be described as fraudulent. He knew what he was doing. Senators are only interested in him showing evidence of utilisation of the fund for committee work.

UNQUOTE

Note that anytime the Senate or House goes into "executive session", something fishy is happening, usually to do with money.

Moving on...

But it appears that the Central Bank is still in denial, except to state that because of “dwindling financial fortunes” – rather than contrition at possibly unethical behavior - it has stopped the practice of such dubious “donations.”

Mind you, we are not stating that the CBN should not donate to universities, for example – God knows that they need it – but it should stop “bribing” the National Assembly, by subterfuge, period.

B. If, for example, after the National Assembly investigation, it is determined that the money was IMPROPERLY disbursed by cash and used for personal benefit by the assemblmen, then:

The N50 million MUST be returned to the Central Bank without delay;

Prof. Soludo MUST be sanctioned somehow for what is CLEARLY a corrupt practice of using public money to in effect “bribe” the Senators – similar to what Osuji did, only with some more professorial “refinement.”

No kid glove should be applied simply because he is Professor Soludo, one of OBJ’s many “whiz kids.” After all, that other person too was also a professor, abi ?

PROLOGUE

What is wrong with us professors, anyway ? Why are we behaving so clumsy financially with public money, to put it mildly ?

Inquiring minds want to know.

I rest my case. We shall be watching.

BIBLIOGRAPHY

http://news.biafranigeriaworld.com/archive/2004/jul/23/026.html

Soludo's N25b solution tears Senate apart

July 23, 2004

http://www.businessinafrica.net/columns/letter_from_lagos/337705.htm

Soludo and the Banks

July 26, 2004

http://news.biafranigeriaworld.com/archive/2004/aug/13/001.html

Senate plans separate capital bases for banks

August 13, 2004

http://news.biafranigeriaworld.com/archive/2004/aug/27/039.html

N25bn banks capitalisation: Amendments to CBN act, BOFIA through in Senate

August 27, 2004

http://allafrica.com/stories/200503141191.html

'Categorisation of Banks Makes a Lot of Sense'

This Day (Lagos) INTERVIEW

March 13, 2005

Controversy Trails CBN's N50m Donation to Nass

Daily Trust (Abuja)

April 6, 2005

A N50 million "donation" made by the Central Bank of Nigeria (CBN), to two committees of the National Assembly is currently generating uproar.

Leadership, a weekly newspaper reported on Monday that the CBN donated N20 million to the Senate Committee on Banks, Insurance and Other Financial Institutions and N30 million to the House of Representatives Committee on Banking and Currency.

This donation said to have been made late last year, reportedly followed a request made by the chairman of the Senate Committee on Banks, Senator Zik Sunday Ambuno, to the CBN Governor, Professor Charles Soludo.

While the public views the donation by the apex bank in the light of bribes allegedly being given to lawmakers by various government establishments, a source in the CBN who prefers anonymity told Daily Trust that "this is part of the bank's social responsibility service to its community (the Nigerian nation).

According to the source, the apex bank had made several similar donations to various public institutions, stressing that "this is not anything new in the CBN."

The source referred our reporters to the Central Bank of Nigeria website for details of such corporate responsibility services.

Daily Trust checks shows that the CBN had contributed N60.5 million to support various activities of the Economic and Financial Crimes Commission (EFCC), in the last financial year alone.

Further checks showed that about N406.5 million was disbursed by the apex bank last year to all federal universities for various projects in those institutions.

Punch newspaper in its edition of Tuesday, April 5, 2005, reported Professor Soludo also emphasising that the donation was in line with the apex bank's social responsibility to support causes that would advance the nation's economy.

Another report also quoted a statement issued by the CBN spokesman, Mr. Tony Ede, on Monday, saying that the bank has directed that such donations should be discontinued effect from last year due to dwindling resources.

When contacted by Senate correspondents over the matter yesterday, the chairman of the Senate committee on information, Senator Tawa Umbi Wada, hinted that Senator Ambuno will address the press today to state his own side of the story.

http://www.thisdayonline.com/nview.php?id=14003

This Day

EFCC Denies Quizzing Soludo

By Ayodele Aminu in Lagos and Kola Ologbondiyan in Abuja, 04.08.2005

The Economic and Financial Crimes Commission (EFCC) yesterday said that it neither quizzed, interrogated nor questioned the Central Bank of Nigeria (CBN) Governor, Prof. Charles Soludo, or any of the bank's officials over the N50 million donation the apex bank made to the National Assembly last year as reported by a national daily yesterday.

The CBN also said that Soludo and top officials had neither been quizzed nor interrogated by the EFCC.

A national daily had reported Wednesday that EFCC had interrogated the CBN Governor and some of his top officials to ascertain whether the N50 million the apex bank donated to the National Assembly last year was to facilitate the passage of the CBN Act and the Banks and Other Financial Institutions Act (BOFIA).

An EFCC statement denying the said publication signed by its Head of Media and Publicity, Osita Nwajah, read in part: “EFCC hereby denies in their entirety, the parts of the story that relates to the Commission.

“For the avoidance of doubts, EFCC did not “quiz”, interrogate or question Prof. Charles Soludo or other officials of the Central Bank over any allegation or ongoing investigation being conducted by the Commission."

The CBN also in a statement said there was no iota of truth in the report.

“We hereby state categorically that there is no iota of truth in the ... report. CBN Governor and top officials have been in Lagos since Monday, April 4, 2005, holding policy and financial surveillance meeting, meeting with boards of directors of the Nigeria Security Printing and Minting Company as well as meeting with Chief Executives and top management of deposit money banks on progress made so far, constraints, challenges and the way forward on the achievement of the N25 billion minimum capitalization of banks through bank consolidaton.

“Running such a tight schedule, it is surprising that the top management of the CBN are being quizzed by the EFCC,” CBN said in the statement signed by the CBN Deputy Director, Corporate Affairs, Tony Ede.

While maintaining that the report is “malicious, sensational, mischievous and obviously intended to dampen the tempo or completely truncate the revolutionary banking sector,” the CBN said it “is aware of the manoeuvring of various interests and groups to employ dirty and unethical means including a smear campaign to take advantage of the current ambience.”

The apex bank added that it has spent over N300 million in various capacity building projects in some Nigerian universities and other government agencies between 1999 and 2004 but decided early this year to stop such projects because of its dwindling fortunes.

“There are hardly any other professional organisations and institutions that promote economic development, monetary and financial policies that have not received donations from CBN,” the statement said.

Meanwhile, the Senate, at an executive session last Wednesday, barred senators from further seeking any sort of "donations or assistance" from ministries, parastatals or the private sector, directing each of the 53 standing committees to work within the budget allocated to it.

The Senate decision, THISDAY gathered, was the outcome of its quizzing of the Senate Committee on Banking, Insurance and other Financial Institutions chairman, Senator Zik-Sunday Ambuno, during executive session, over his committee's alleged demand of N50m donation from the CBN.

According to a Senator, who participated in the executive session, "we have resolved that henceforth no senator should seek any form of donation or assistance from any ministry, parastatals or the private sector. Every committee should also work within the ambit of the budget allocated to it (committee).

"We also put the banking committee chairman, Ambuno, on the spot and asked him to explain to the whole house what his roles are in the said "donation" to enable the Senate to receive first-hand information.

"He (Ambuno) admitted writing the letter seeking assistance from the CBN” the source said.

However, what we have done is to discuss the matter and ensure that it does not hit us like a flash as did the on-going N55m bribe-for-budget scam.

"What could be called the high point of the floor was that Ambuno should come forward with facts and figures on how the donation was spent on hiring consultants, holding public hearing and producing the amended Central Bank of Nigeria (CBN) Act as well as the Banks and Other Financial Institutions (BOFI) Act but the matter is yet to be concluded.

"This high point was arrived at on the basis of CBN admission that they approved the N50m donation from which the Senate Committee received N20m and that the CBN offers such assistance once a while. Also, the letter Ambuno sent to CBN was on his letterhead so it could not be described as fraudulent. He knew what he was doing. Senators are only interested in him showing evidence of utilisation of the fund for committee work.

"If we had taken past allegations with the seriousness and accuracy they deserved, the Senate would not have found itself in the current cul-de-sac. But you know we have a new Senate President and we are bent on putting the filthy past behind us," the source added.

http://www.charteredbank.com/news_detail.asp?newsid=8

Senate redefines shareholders funds

Friday, February 11, 2005

In a move that runs parallel to the Central Bank of Nigeria’s position, the Senate amended both the CBN Act and the Banks and Other Financial Institutions (BOFIA).

Under the amendment act, banks have been categorized along Mega banks, Medium bank and small banks. The paid-up share capital plus shareholders’ fund for this different category as stated in the act are; N25 billion, N10 billion and N5 billion respectively. Justifying this act, chairman of the Senate committee on banks while briefing news men said it was not fair to compel smaller banks, which were not into large scale financial transactions to operate on the same minimum capital base with the big ones

It would be noted that the CBN governor, Professor Charles Soludo in his July 6, 2004 address to banks’ top brass had pegged the minimum capitalization for deposit-taking banks to N25 billion with December 31, 2005, as the deadline for compliance.

However, some stakeholders oppose the senate's stand on the matter. The deputy chairman, House of Representatives committee on banking and currency, Honorable U.S.A Igwe described the amendment as a mere proposal anchored on its decision, which is not yet law. He explained that the house would also make a decision on the matter before the bill will be passed. Speaking in the same direction, some banking top brass claimed it’s just a bill and not a law. They affirmed that the House of Representatives will have to look at it or pass it and even when they pass it, the president will have to sign it into law.

Whereby the president refuses to sign it, the National assembly has up to 30 days before they can veto the president’s decision.

Based on such length of time and processes, December 31st, 2005, as the deadline would have been around and the apex bank could have carried out its planned penalty.

RETURN

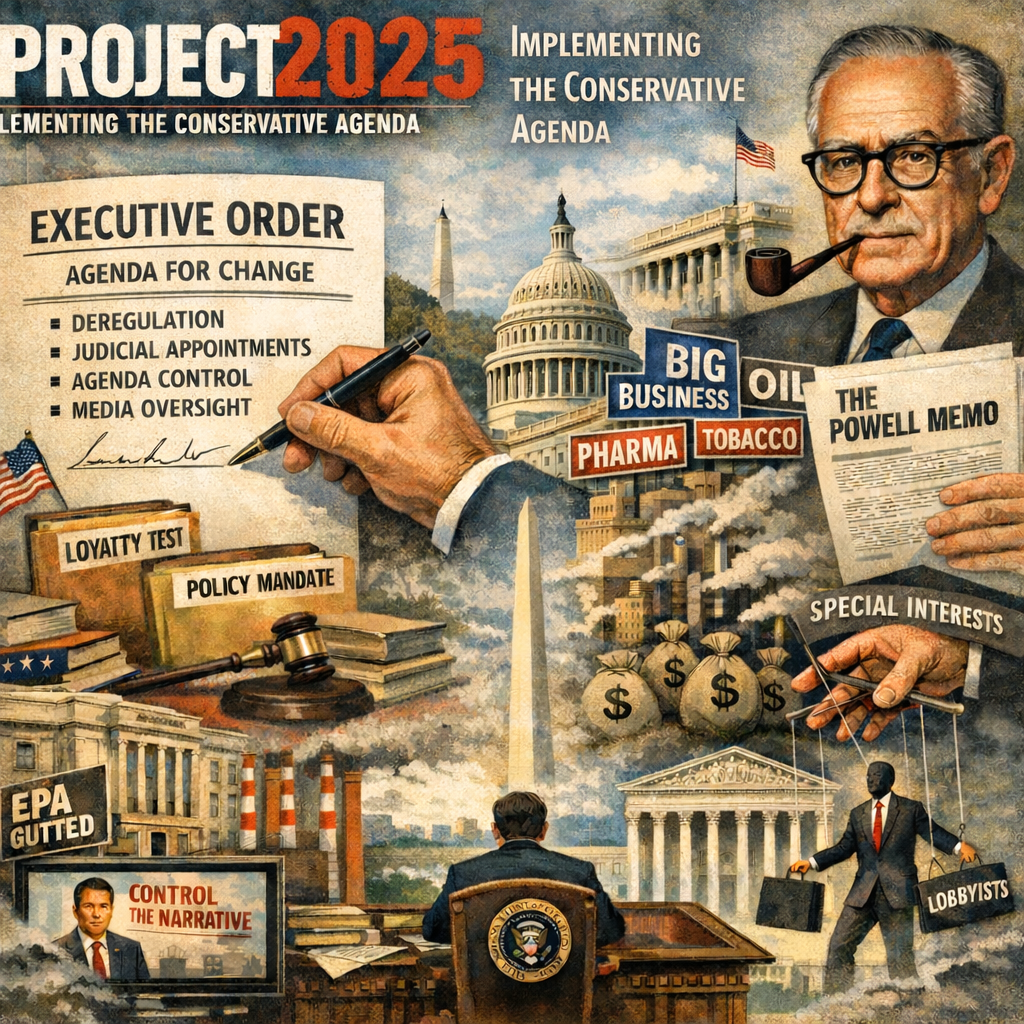

From the Powell Memo to Project 2025: How a 1971 Corporate Strategy Became a Global Template for Power In August 1971, a corporate lawyer named L...

The Market’s Mood Ring: How Volatility Across Assets Traces a Hidden Geometry of SentimentIf you want a fast, honest way to describe modern markets,...

Nigeria’s grid collapses are not ‘bad luck’ – They are a design failure, and we know how to fix themFirst published in VANGUARD on February 3,...

Islands of Credibility: Nigeria’s Best Reform Strategy Starts in the StatesFirst published in VANGUARD on January 31, 2026 https://www.vanguard...

Project 2025 Agenda and Healthcare in NigeriaThe US and Nigeria signed a five-year $5.1B Memorandum of Understanding (MoU) on December 19, 2025, to bo...