INTRODUCTION – BATTLE OF THE GENERALS DEFERRED

I know that Generals Obasanjo and Buhari, two (re)tired army generals, announced their presidential candidacies under PDP and APP respectively yesterday. I also know that we are waiting for General Odumegwu Ojukwu (re)tired, to throw in his hat into the ring to complete the ethnic triumvirate of ex-military men turned politicians duking it out on our political ring-space.

But right now, I shall not be distracted. I shall focus like a laser beam on Revenue Allocation, because all these presidential aspirants, no matter what they tell you, are only after the nation’s money, money that they want to control as president. Each of them of course is cock-SURE that he is the one who can best manage the oil money for the development of the country, if only they were allowed four more years (Obasanjo) or just four years (Buhari, Ojukwu.)

We of course, all know better.

So let us talk once more about revenue allocation.

PROBLEM NUMBER ONE OF THE SUPREME COURT RULING – ILLEGAL FIRST CHARGE

Ever since the Supreme Court Ruling on Offshore/Onshore Dichotomy (a.k.a. Resource Control) of April 5, 2002, the Federal Government and the oil-producing littoral states have been singing the blues, scampering for what to do. The 2002 Budget has been thrown into disarray; president Obasanjo has had to withdraw from National Assembly consideration the new Revenue Allocation Formula that had been prepared for him by the Revenue Allocation Committee– and Akwa-Ibomites (in particular its State Governor Obong Attah) have been shouting “Blue Murder!” over “zero allocation” in the month of April 2002! More dramatically, the Senate has presented a resolution asking the Supreme Court to please “stay execution” – in short, the Supreme Court ruling amounted to a “death sentence” for some people!

What really has happened? What is the problem?

In a previous essay [MID-WEEK ESSAY: Simplifying Our Revenue Allocation Formula Once and For All” April 17, 2002], I made an attempt at clarification, but an updated summary is probably pertinent here. In previous years – say 1998 - under the military, a N1 trillion budget (roughly the budget for 2002), of which typically about N700 billion was derived from oil - would first have had about N530 billion siphoned off into “First Charges” under federal government control. The remaining N470 billion (put in the Federation account) would have had 7.5% of it - or N35 billion – siphoned off into “special funds” charges. The remaining N435 billion would then have been composed of a split of the N470 million in the proportion 48.5:24:20 between Federal, State and Local Governments as N228 billion, N113 billion and N94 billion respectively.

Thus in effect, we would have had a 79.3:11.3:9.4 percentage split between the three tiers of government.

Under the military dispensation, of the N35 billion special charges, N4.7 billion (1% of the N470 billion) would have been put in a Derivation pot, and 13% of that - N611 million – statutorily given to the oil-producing states.

Akwa Ibom would have received 22% of that N611 million – or N134 million. [In round numbers, from the oil derivation pot, Delta receives 30% monthly, Rivers and Bayelsa 18%; Ondo 7%; Imo 2.5%; Cross River 2.3%; Abia 1.4% and Edo the remainder !]

However, since Obasanjo became president in May 1999, but more specifically beginning in January 2000 up until the time of the Supreme Court Resource Control ruling, what has been allocated to the oil producing states has been 13% of oil revenue derived – for example, in the case we are looking at, that would have been 13% of N700 billion – or roughly N90 billion – with Akwa Ibom receiving N20 billion of that. The first line charge would still have been N530 billion, but now what would have been in the Federation Account would be N380 billion (rather than the former N470); with N29 billion set aside for Special Funds, N184 billion for the Federal Government, N91 billion for the State Governments and N76 billion for the Local Governments.

Thus, in effect, the Obasanjo pre-Supreme Court ruling era had the split: 74.3: 18.1: 7.6 percentage split between the Federal, State and Local Governments. [Compare with military-era 79.3: 11.3: 9.4] The big “loser” here is the federal government – but it still has a sizable chunk under its control - and the big winners, in fact the ONLY winners, were the oil producing states.

Consequently, in fairness to the Obasanjo regime, the oil-producing states have increasingly had it much better than under the military regime, as Table 1 shows. For example, for the last six months of 1999, Akwa Ibom (just to pick one state) received N2.6 billion, but for year 2000 it received N19.7 billion, then N31 billion in 2001. For the first three months of 2002, it has received (from derivation alone) N4.460 billion, and is hence on course to receive N18 billion from derivation alone – or possibly as much as N40 billion total (if the rate of increase is maintained), or even N154 billion (see below).

One wonders whether this increased multiple-fold revenue increases depicted in Table 1 has translated to a substantial improvement in the lives of citizens of the oil-producing states.

In any case, so what has the Supreme Court ruling wrought?

For one, it has declared the “first charge” illegal, AND the special funds illegal too! What that means is that after separating the N90 billion 13% oil derivation, ALL the remaining N910 billion should go into Federation Account pot, to be distributed according to the (proposed revised, by rumor) 52 : 26: 22 Federation account ratios (no longer 48.5; 24: 20), that is N473 billion to the Federal government, N237 to the States and N200 to the local governments! Thus, in effect, the new post-Supreme Court no-dichotomy ratio now would be 47.3 : 32.7 : 20.0 Federal, state and local government, thereby forcing Obasanjo’s civilian regime to almost halve the previous military-era Federal government allocation, almost triple the state government allocations and more than double the local government allocations! However the increased state and local government allocations are now spread AMONG all of the states and local governments, and not just the oil-producing states.

This is what has been giving the Federal government nightmares – both the Executive and the National Assembly (which has a stake in having its hands on federal money).

PROBLEM NUMBER TWO: ONSHORE/OFFSHORE DICHOTOMY

The story is not complete, however, for the oil-producing states because of the on-shore/off-shore dichotomy Supreme Court ruling against them! At present, Akwa-Ibom has virtually 100% of its oil OFFSHORE; Ondo about 85% offshore, and Delta, Rivers and Bayelsa about 15%. What this means is that 22% + 0.85 of 7% + 0.15 of (30% + 18% + 18%) or about 41% of the total oil derivation money of N90 billion (that is N37 billion) should ideally be returned to the Federation account (not just to Federal government coffers), to be re-distributed in the putative 52:26:22 ratio.

Consequently, the post-Supreme Court dichotomy ratio would really be (473 + .52*37 : 237+53+.26*37 : 200 + .22*37 49.2) or the ratios 49.1: 30.0 : 20.8 Federal, state and local governments percentage split respectively.

In absolute naira figures, how do the oil-producing states fare? In a trillion-naira budget, instead of getting from derivation ALONE:

(i) 30% of N700 billion (N210 billion), Delta would get N178.5 billion; a N22.5 billion shortfall.

(ii) 22% of N700 billion (N154 billion), Akwa-Ibom would get zero allocation ; a $154 billion shortfall.

(iii) 18% of N700 billion (N126 billion), Bayelsa and Rivers would each get N107 billion; a N19 billion shortfall.

(iv) 7% of N700 billion (N49 billion), Ondo would get N7.4 billion; a N41.6 billion shortfall.

(v) Cross-River, Abia and Imo, with onshore (or creek) oil, would lose no derivation money.

(vi) States with on-shore gas deposits would add those appropriate proportion of the gas revenues to their income.

48% of this shortfall is however RETURNED to ALL of the states and local governments – ie on average each of these states would recover only N0.5 billion from derivation alone!

The ratios so far are summarized in Table 2.

PROBLEM NUMBER THREE: PAY-BACK TIME!

Finally, there is a double whammy – and unintended consequence - against some of the states, particularly Akwa-Ibom and Ondo States: the states do not only have a shortfall, but they are now being asked to refund the money allocated to them since the inception of this administration as they got the allocations illegally! In fact, it was reported that Akwa Ibom would be made to begin to refund N33.4b immediately (hence its zero allocation in the month of April!) while Ondo would refund N8 billion to the Federal Government. Looking at Table 1, for Akwa Ibom, if we take away the $4.46 billion derivation money in received in January – March of 2002, that means that it has to refund N28.94 billion derivation money out of the N50.7 billion that it has received since January 2000 – that is 57% of its money received between January 2000 and December 2001 gets taken away. For Ondo State, we take away N2.429 from N8 billion to get N5.571 billion out of N27.4 billion – or 20% of the money it received since January 2000 and December 2001 taken away.

Tough, very tough!

PROBLEM NUMBER FOUR: DEBT AND THE VARIOUS TIERS OF GOVERNMENT

There was another troublesome ruling of the Supreme Court, which was a fall-out from declaring illegal debt as part of first charge – that each tier of government should be responsible for its own debt.

How much is this debt ? I do not know what it is for 2002, but I do know it for 1988 (when there were just 21 states), as shown in Table 3, indicating that the states’ contribution to the external debt was about 15.3%, with the North (8.6%) and the South (6.7%) having their own share. The 2002 figures may not be accurate for each state, but it is likely to be within spitting distance of the correct ones within each geopolitical region. The figures show that the Naira external debt burden for the states in 2002 could be quite high – $4.36 billion (roughly N493 billion) out of Nigeria’s total $28.5 billion. Now the Supreme Court says that the states will have to bear their own burdens, some inherited from predecessor states, others incurred by the new states themselves.

THE SEARCH FOR A POLITICAL SOLUTION

From all the above considerations, little wonder then that the Federal government is scrambling, Akwa Ibom is shouting “Blue Murder” and the Senate is asking the Supreme Court for “stay of execution!”

What has the Federal government being doing in the interim? A few illegalities one might add, including:

(1) suggesting that the FCT (which was judged not to be a state by the Supreme Court, and hence illegally being funded as such) should be considered a state FOR THE PURPOSES of revenue allocation. Consequently, it has gone ahead to surcharge the three tiers of government in the ratios 52:26:22 to pay for that 1% FCT allocation. This amounts to the Federal government COMMITTING lower tiers of government to monies that have not been appropriated by their state assemblies – another unconstitutional move!

(2) It has made a similar move with its oil Joint Venture (cash) Calls for – surcharging the states accordingly!

(3) it has held back altogether derivation allocations, while the Revenue Allocation committee works out its new formula. One would have expected the federal government to at least pay out the 13% MINIMUM stipulated by the Constitution.

In an election year, and in Nigeria’s political climate, it is most unlikely that the Supreme Court ruling will be FINAL. But now that we have heard a legal voice from the Supreme Court, what political solutions might we arrive at? I make five suggestions here:

1. We should change the Federation Account ratios to 52.1 : 25.9 : 22.0 Federal, State and local governments and thereby get the Federal Government to pay for Abuja FCT from its own share (52.1%) of the account rather than commit the states and local government to support the FCT and/or regard the FCT as a state – which it is not.

2. We should all “forgive” Akwa Ibom and Ondo (and any other states) of their past over-allocations – no payback, no zero allocation please, we are all brothers and sisters! Let bygones be bygones!

3. For the Joint Venture Calls, the Federal Government should IMMEDIATELY continue with its recently-announced move of making NNPC stand on its own as a commercial enterprise with no cash support from the Federal government, with NNPC paying a percentage of profits into the Federation account. [Strict accounting please, no Enron-like innovative accounting.] In the time being, it should take the Falae suggestions of seriously reducing our exposures in these Joint Ventures (and raising some money thereby) in favor of Production Sharing Contracts (PSCs.)

4. For onshore oil (natural resources), 13% derivation should be stipulated ONCE and FOR ALL to be given to the oil-producing states.

5. For offshore oil (natural resources), however, we should have:

- 63% to the Federal Government (50% + 13% derivation for FG). The federal government is free to re-distribute this in the way and manner that it sees fit – or not at all.

- 6% to all the 8 LITTORAL Local Governments, (not just the oil-producing ones) divided to each in some amounts inversely proportional to the distance to the local government headquarters - and directly proportional to the revenue yield - of each oil producing field (the total amounts to a 6 nautical mile claim out of a 200 nautical miles offshore economic zone; local governments closer to fields get more than those farther away);

- 25% to all the 17 Southern States (including the littoral states), divided equally;

- 6% to all the 19 Northern States, divided equally. This is a concession to our land-locked Northern compatriots.

Note that by my Recommendation Number 5, the 8 littoral states and their local governments get roughly a total of 15% of the offshore oil revenue, but unlike the onshore oil, they do not get another share of the rest of the 85%. Of that one, the federal government gets 63%, all the other non-oil-producing Southern states get 16%, and the Northern states 6%.

Recommendation 5 is not a capricious one, as it may first read. When Nigeria began as an independent country in 1960, the 3 regions of the South were the littoral ones, and 50% of the resources of the ocean were due to them. Since the creation of states, that portion of the littoral South has dwindled both in size and number from the 3 large regions to 8 much smaller states, yet that rump (of noveau-littoral states rather than regions) would now claim all the resources out to 200 nautical miles of the ocean.

That should not be. If we are to be fair to the delicately negotiated 1960 Independence Constitution (and 1963 Republican Constitution), ALL of the Southern States (and not just the present littoral states) should enjoy that 50% allocation. Otherwise, if we were to take an absurdity to the limit, if tomorrow all the littoral local governments were to become states, then they too would claim resource control of the oceans – up to 200 nautical miles. One more absurd thought: if a sliver of towns EXACTLY along the coast were to constitute themselves into states, then each could claim 200 nautical miles into the Atlantic Ocean!

That obviously would be absurd.

Recommendation 5 is therefore a fair re-alignment of our 1960 constitutional beginnings as an independent country.

EPILOGUE

One is aware that the issues of revenue allocation and resource control are emotional ones in Nigeria, particularly after so many years of economic deprivation of the Niger-Delta. Nevertheless, some hard-nosed decisions now have to be made in light of the recent Supreme Court ruling.

I have suggested some of them above. If we must remain a united country, then we must all own certain natural resources: the air above us and the oceans should be jointly owned.

Table 1: Allocations from Federation Account June 1999 to March 2002

Total Distributions (billion Naira)

June – Dec 2000 2001 Jan+Feb+March 2002

1999 [Derivation Only]

Delta (85/15) 2.0 24.7 41.7 1.996+1.633+2.447* = 6.076

A-Ibom (10/90) 2.6 19.7 31.0 1.466+1.200+1.794* = 4.460

Bayelsa (85/15) 2.0 15.9 26.5 1.210+0.990+1.485* = 3.685

Rivers (85/15) 2.6 17.7 30.2 1.210+0.990+1.485* = 3.685

Ondo (10/90) 2.0 10.2 17.2 0.469+0.384+0.576* = 2.429

Imo (100/0) 1.9 7.5 n/a 0.168+0.137+0.205* = 0.510

Abia (100/0) 1.7 6.2 11.2 0.093+0.076+0.114* = 0.283

Edo (100/0) 2.0 6.7 10.9 0.038+0.032+0.051* = 0.121

Total 15.8 108.6 168.7 6.651+5.442+8.157 = 20.250

Total Distributed 109.070+70.197+120.381 = 299.648

Total FGN 51.260+32.705+53.927= 137.892

Total State + FCT 33.077+22.303+39.047= 94.427

Total LG 21.141+13.489+24.347= 58.977

Total Special Funds 3.592+ 1.700+ 3.060= 8.352

Source: various newspaper publications on the Internet (see Bibliography)

* calculated as appropriate percentage of accurately known total for the month of March 2002

n/a – not available

Table 2: A Comparison of Total Federal, State and Local Government Revenue Allocation Ratios

Federal State LG

Military Era 79.3 11.3 9.4

[Oil-producing states derivation] (0.06%)

Civilian Pre-Supreme Court Ruling 74.3 18.1 7.6

[Oil producing states derivation] (13%)

Civilian Post-Supreme Court, No-Dichotomy 47.3 32.7 20.0

[Oil-producing states derivation] (13%)

Civilian Post-Supreme Court, Dichotomy 49.1 30.0 20.8

[Oil-producing states] (7.7%)

TABLE 3: Estimated Debt Table for States in Nigeria

1988 Debt 1988 Debt @

Dollar million Naira % total 2002 Billion Naira

(million) (at $1 : N7.00) (at $1 : N113)

SOUTH-EAST

Imo {+Abia+Ebonyi} 305.1 2,135.7 1.23 34.48

Anambra {+Enugu+Eb.} 296.5 2,075.5 1.19 33.50

Subtotal 601.6 4,211.2 2.42 67.98

SOUTH-WEST

Ondo {+ Ekiti} 219.6 1,537.2 0.88 24.81

Oyo {+Osun} 214.9 1,504.3 0.86 24.28

Lagos 104.1 728.7 0.42 11.76

Ogun 0.0* 0.0 0.00 0.00

Subtotal 538.6 3,770.2 2.16 60.85

SOUTH-SOUTH

Bendel {+Edo} 301.2 2,108.4 1.21 34.04

Rivers {+ Bayelsa} 148.8 1,041.6 0.60 16.81

Cross-River 65.8 460.6 0.26 7.44

Akwa-Ibom 0.0* 0.0 0.00 0.00

Subtotal 515.8 3,610.6 2.07 58.29

NORTH-CENTRAL

Benue } {+Nassarawa} 568.9 3,982.3 2.28 64.29

Plateau } 512.3 3,586.1 2.06 57.89

Kwara } {+ Kogi} 347.7 2,433.9 1.40 39.29

Niger 141.1 987.7 0.57 15.94

Subtotal 1,570.0 10,990.0 6.11 177.41

NORTH-WEST

Sokoto {+Zamfara+Kebbi}280.0 1,960.0 1.12 31.64

Kano {+Jigawa} 62.1 434.7 0.25 7.02

Kaduna 0.0* 0.0 0.00 0.00

Katsina 0.0* 0.0 0.00 0.00

Subtotal 342.1 2,394.7 1.37 38.66

NORTH-EAST

Gongola {=Adam.+Taraba}284.5 1,991.5 1.14 32.15

Borno {+Yobe} 0.0* 0.0 0.00 0.00

Bauchi {+Gombe} 0.0* 0.0 0.00 0.00

Subtotal 284.5 1,991.5 1.14 32.15

Total South 1,656.0 11,592.0 6.65 187.12

Total North 2,196.6 15,376.2 8.62 248.22

Grand Total States 3,852.6 26,968.2 15.27 435.34

[$3.8526 billion] [N26.9682 billion]

Federal Government (round figures):

ICM 14,200.0

Bilateral loans 1,800.0

World Bank 3,500.0

Total Federal 19,500.0

Rescheduled Principal 1,526.0

Capitalized Interest 29.1

SubTotal 1,555.1

Grand Total Federal $21.055 billion N147.385 billion 84.73 2,379

Grand Total Debt $24.9 billion N174.3 billion 100.00 2,813

(External)

Source; SB Falegan “Nigeria’s External Debt Burden”; Fountain Publications (1992)

APPENDIX I

Vanguard

New revenue formula bill coming

Monday, 29th April, 2002

By Emeka Anaeto, Business Editor

LAGOS — THE Revenue Mobilisation, Allocation and Fiscal Commission (RMAFC) has begun moves to effect a far-reaching reform in the revenue allocation formula in line with the recent ruling on the issue by the Supreme Court.

To this end, the commission has set up a seven-man ad-hoc committee to review the revenue formula bill now before the National Assembly.

The chairman of the commission, Alhaji Hamman Tukur, said in a statement yesterday in Abuja that the committee with Dr. Emmanuel Nsan as chairman, has two weeks to submit its report.

Members of the committee, are Elder Effang Inyang, Alhaji Yakubu Muhammad, Mr. A. A. Abidogun, Alhaji Abubakar Sadauki, and Mr. Emeka Wogu, while Alhaji Abdullahi Maiunguwa, would serve as secretary of the committee.

Alhaji Tukur said that as the constitutional body empowered to review revenue allocation formula, the commission last week took some far-reaching decisions on the verdict.

He also said that the ad-hoc committee would ensure that the new revenue sharing formula earlier submitted, reflected the Supreme Court judgement, taking into consideration the relevant provisions of the 1999 constitution.

The review is expected to restructure the federation account positively.

Federal Government currently effects first and second line deductions from federally collectable revenue before declaring a balance for sharing among the three tiers of government.

BIBLIOGRAPHY

http://www.dawodu.com/aluko10.htm

Simplifying Our Revenue Allocation Formula Once and For All

Mobolaji E. Aluko, Ph.D.

Wednesday, April 17, 2002

History of Exchange Rates 1970 - 1999

http://www.ngex.com/personalities/voices/balukonaira.htm

http://allafrica.com/stories/200205170196.html

As Supreme Court Judgement On Resource Control Bites Harder On Government, States, Senate Wants Stay of Execution

This Day (Lagos) May 17, 2002

http://allafrica.com/stories/200105150434.html

Nigeria Hosts International Conference On Debt Strategy

Panafrican News Agency May 15, 2001

http://www.thisdayonline.com/news/20020408beh01.html

Who Controls the Resources?

By Olusegun Adeniyi (March

http://allafrica.com/stories/200203220050.html

Akwa-Ibom Assembly Passes N58.7 Bn 2002 Appropriation Bill

This Day (Lagos) March 22, 2002

http://www.thisdayonline.com/news/20020510news04.html

May 10, 2002

As S/south Govs Meet Today Over Resource Control...

Obasanjo Withdraws Revenue Allocation Bill

http://www.nigerdeltacongress.com/darticles/decolonization_through_resource_.htm

Decolonization through resource control

Ita Awak

http://www.deltastate.com/articles/dafinone.asp

THE 13% DERIVATION FUND CONTROVERSY

Senator David Dafinone's submission on the Fund

http://www.unesco.org/most/crossroadsedl.htm

Federalism, Fiscal Centralism and the Realities of Democratisation in Nigeria: The Case of the Niger Delta

Edlyne E. Anugwom

http://allafrica.com/stories/200204060138.html

Supreme Court Structures Federation Account

This Day (Lagos) April 6, 2002

http://allafrica.com/stories/200202040126.html

January 2002Allocation Short By N15bn (Total N76.951 billion)

This Day (Lagos) February 4, 2002

http://allafrica.com/stories/200202270132.html

February 2002 - Government, States Share N70.197bn

This Day (Lagos) February 27, 2002

http://allafrica.com/stories/200203250551.html

March 2002 - FAAC Disburses N120bn to Government, States, LGs in March

Vanguard (Lagos) March 25, 2002

2001

December 2001 - Government, States, LGs Share N109bn

The meeting to the Federation Accounts Allocation Committee (FAAC) considered and approved the allocation of revenue among the beneficiaries of the account for the month of December, 2001. The total amount shared was N109,070 billion which was distributed as follows: Federal Government, N51,260 billion, State Government and Federal Capital Territory (FCT) N33,077 billion, Local ...

http://allafrica.com/stories/200201090634.html

Novemeber 2001 Government Releases N143.5bn November Allocation

THE Federal Government has released the sum of N143.590 billion to the three tiers of government for November.

http://allafrica.com/stories/200111261000.html

Government, States Share N136.7 Bn for November

The monthly meeting of the Federal Account Allocation Committee (FAAC), held last week in Abuja, approved the allocation of N136.691 billion revenue among beneficiaries of the Account for the month of November which included the third installment of N19.489 billion from GSM proceeds and N13.681 billion from excess income on crude oil sales.

http://allafrica.com/stories/200111260629.html

October 2001 - FG, States, LGs Share N139bn

N38.9bn GSM proceeds included.

http://allafrica.com/stories/200111130340.html

September 2001 FG, States, Local Govt Share N116.6bn

The Federation Account Allocation Committee (FAAC) has approved the distribution of N116.611 billion between the Federal, State and Local Governments as revenue allocation for the month of September.

http://allafrica.com/stories/200110040099.html

August 2001 Governemnt Shares N132.4b With States, Councils

A TOTAL of N132.413 billion was shared by the Federal Government, states and councils from the Federation Account last month.

http://allafrica.com/stories/200109120105.html

FG, States to Share Excess Funds

Following sustained agitations and recriminations, the Federal government yesterday succumbed to pressure from states and local councils to share the excess $1.1 billion earnings from crude oil sales among the three tiers of government.

http://allafrica.com/stories/200108220121.html

May 2001 - Federal Government Releases N67b May Allocation

The Federation Account Allocation Committee (FAAC) has released N67 billion to the three tiers of government as their share from the federation account for this month.

http://allafrica.com/stories/200005230302.html

. http://allafrica.com/stories/200104020047.html

Focus On Controversy Over Control of Resources

UN Integrated Regional Information Networks April 2, 2001

In January, the federal government moved to tackle one aspect of the dispute by filing suit in the Supreme Court to obtain clarification of a constitutional provision that states should receive 13 percent of the revenue from natural resources on their territory.

Since assuming office, Obasanjo has permitted payment of only 7.8 percent of oil revenue to the oil-region states, on the grounds that the remainder represents offshore production that does not come under the jurisdiction of the coastal states. When others argued that the constitution made no such distinction, Obasanjo's response was to seek Supreme Court intervention.

RETURN

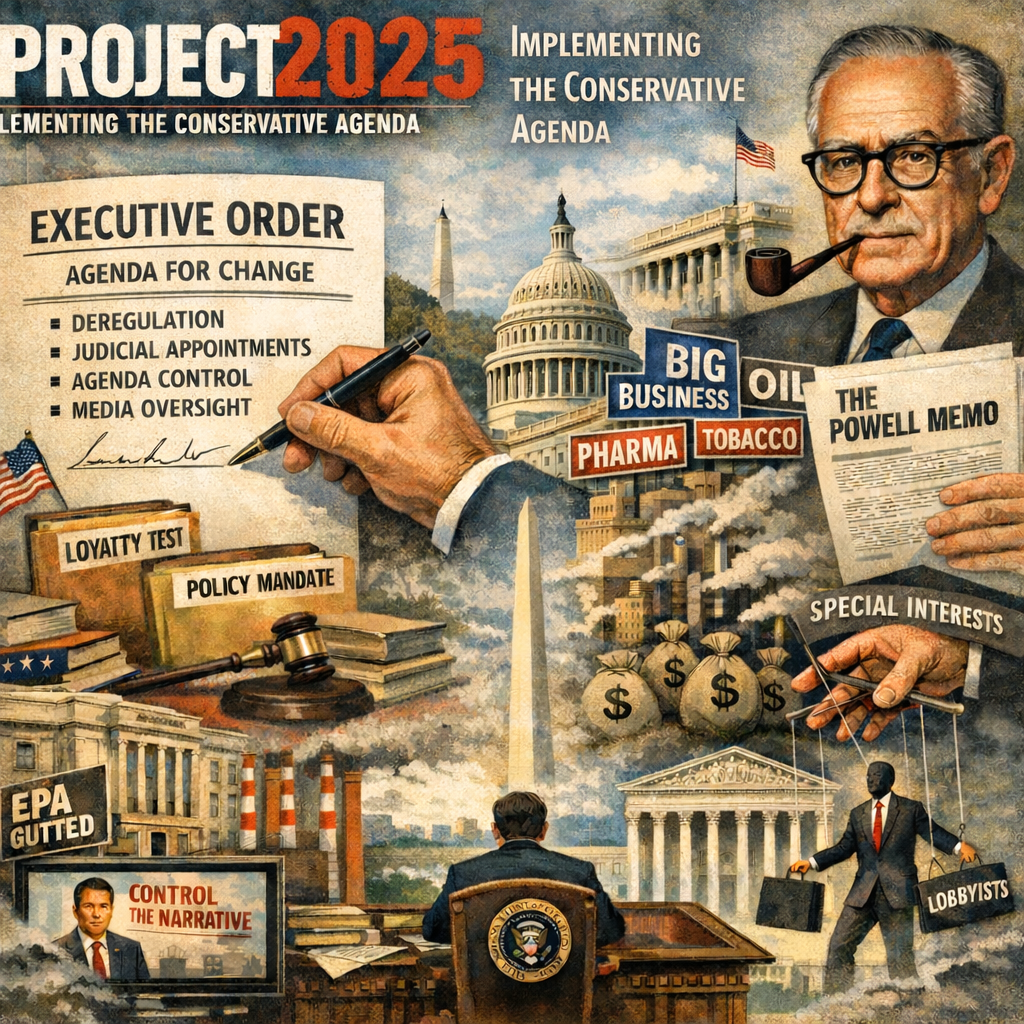

From the Powell Memo to Project 2025: How a 1971 Corporate Strategy Became a Global Template for Power In August 1971, a corporate lawyer named L...

The Market’s Mood Ring: How Volatility Across Assets Traces a Hidden Geometry of SentimentIf you want a fast, honest way to describe modern markets,...

Nigeria’s grid collapses are not ‘bad luck’ – They are a design failure, and we know how to fix themFirst published in VANGUARD on February 3,...

Islands of Credibility: Nigeria’s Best Reform Strategy Starts in the StatesFirst published in VANGUARD on January 31, 2026 https://www.vanguard...

Project 2025 Agenda and Healthcare in NigeriaThe US and Nigeria signed a five-year $5.1B Memorandum of Understanding (MoU) on December 19, 2025, to bo...