Expectedly, the Governors of the 17 southern states rose from its third

summit in Benin City, the Edo State Capital, March 27, 2001, and proclaimed

its preference for fiscal Federalism based on the principles of national

interest, need and derivation. Its communiqué at the end defines resource

control as "the practice of true federalism and natural law in which the

federating units express their rights to primarily control the natural

resources within their borders and make agreed contribution towards the

maintenance of common services of the government at the centre. This dogma

is not true in its entirety as the individual and not the state is the final

repository of this General Will. The benefits of resource control according

to Chief Obafemi Awolowo should accrue to the individuals and not the state

following the principles finally expatiated upon by Adam Smith in The Wealth

of Nations in 1776.

But I am fascinated with the succinct manner the host of the summit, Mr.

Lucky Igbinedion put it to reporters. He said, "Resource control means that

if I as a Bini man goes to Kebbi State and finds gold, the resource should

belong to me and not the state or the federal government. All I owed the

Federal Government is to pay taxes and royalties. The same principle should

apply if a Kano man comes to Edo, Delta or Bayelsa and strikes oil. He only

pays royalties and taxes to the state or the federal government".

The issues at stake in Nigeria's economic philosophy is that the current

formula for the distribution of the nation's wealth is unacceptable. As

members of the same family, the President of the Federal Republic of Nigeria

owes it as a duty to call all shades of opinion to decide the matter rather

than the pursuit of the matter through the legal process. The action of the

Federal Government in dragging the 36 state governments and the Federal

Capital Territory to the Supreme Court to seek judicial interpretation of

the constitutional provision on the matter may turn out whatever the

outcome, as an ill wind which could cause a tremour which the Federal

Government cannot control. Also, the Federal Government suite asking the

Supreme Court to define the seaward boundary of a littoral state within the

federal republic for the purpose of determining the amount of revenue

accruing to the federation account directly from any natural resources

derived from the State as contained in the section 162(2) of the

Constitution of Nigeria is based on the false premise of ignoring Section

162(1) which initiated the provision that all funds collected by the Federal

Government with the exception of the personal income tax of the police,

armed forces, the foreign affairs ministry and the residents of the Federal

Capital Territory, Abuja accrues to the Federation Account. These raises

the issue of what the Federal Government intends to do with the on-shore

off-shore funds if they are not going into the Federation account. For, if

section 162(1) is to be applied, then, the basis for the writ without

prejudice to the decision of the Supreme Court would be called to question.

Equally, there is an existing Act namely No. 106 of 1992 of Federation

Account, etc., Amendment Act which states, "For the purpose of subsection

(2) of this Section and for the avoidance of any doubt, the distinction

hitherto made between on-shore oil and off-shore oil mineral revenue for the

purpose of revenue sharing and the administration of the fund for the

development of the oil producing areas is hereby abolished". The question

then arises: Are we asking the judiciary by fiat to make new laws?

Resource control is a basic economic theory grounded in the fact that land,

labour, capital and entrepreneurship are factors of production (Adam Smith,

an early economist, outlined these in The Wealth of Nations the principal

factors of production. These are land, labour, capital and

entrepreneurship. Just as the price of labour is wages, capital has

interest, entrepreneurship is driven by profit while rent and royalties are

rewards for landownership. Rent is a return for the use of the original and

indestructible properties of the soil. Whoever owns a land expects some

form of compensation from those hiring this very important factor of

production. The clamour for resource control is a clamour for adequate

compensation, a cry for redistribution of the revenue allocation formula,

and nothing more. The only thing a government should do is to impose tax to

be used for the welfare of the community. This theory has been in existence

since the creation of man and is correctly reflected in the Bible. If you

change these rules ordained by God, then you invite chaos. Hence the Psalm

says, "change and decay around I see; oh thou who changeth not, abide with

me".

To be fair, the statutory distribution of revenue from the Federation

Account had been controversial as well as contentious. The Political Bureau

Report of 1987 observed that the issue is so contentious that "none of the

formula evolved at various times by a commission or by decree under

different regimes since 1964 has gained general acceptability among the

component units of the country".

But the Report also observed that the issue of revenue allocation and to be

specific derivation, had been essentially a political rather than an

economic tool. Whoever is in charge introduces a formula that best serves

his interest. The British administered the country initially mainly from

the proceeds from oil palm trade derived largely from the then Eastern

Region. Derivation was not given any prominence. But when groundnuts and

tin from the North and cocoa and rubber from the West became major earner of

revenue, derivation, to use the words of Dr. S. J. Cookey in his report,

"was catapulted into a major criteria for the allocation, thus underscoring

the linkage between regional control of the political process and the

dominant criteria for revenue allocation at any given time. This linkage

was further underscored when, following the increasing importance of

petroleum derived mainly from the Eastern States (now Niger Delta) as a

revenue yielding source, derivation was again de-emphasised. And now, it

is instructive to note that the exclusive federal jurisdiction over a

natural resources apply only to oil and gas, and not to cocoa, palm oil,

hides and skin, bitumen, marble, etc. This is the core of the agitation of

the people of the South-South Region.

To be sure, the practice of federalism had been so traumatic, making some to

blame it on the "mistake of 1914." Even so, our nationalists who negotiated

the form of our existence made some efforts to stimulate healthy competition

among the regions. The 1958, 1960 and 1963 Constitution allowed for

competition among the various segments of the society now. The 1963

Republican Constitution was not a perfect document but its stance was clear

on issues of the society, issues that were central to federalism. It

directed that revenue derived from imports be paid 100 percent to the state

in proportion to the consumption of the product. The same goes for Excise

Duty: 100% payment to the state according to the proportion of the duty

collected. For minerals, the constitution shares the revenue in the

proportion of 50: 20: 30; i.e. 50 percent for derivation, 20 percent to the

Federal Government and the remaining 30% paid into the distributable pool to

be shared among the states, including the Donor State. It was not perfect,

but it made up somehow for past mistakes.

However, the advent of the Military in power made nonsense of our

federalism. Based on its hierarchical command structure, the central

government became so powerful while the states are relegated and

subordinated, or like the Soviet Federalism of old, " mere administrative

units of the central government. But federalism is the direct opposite, the

coming together of different entities for the good of all but not the loss

of their respective independence." Like I have said before, at a different

occasion, Nigeria fought a little civil war to safeguard the federation.

(It is my considered opinion, from all available facts that the civil war

was caused by the betrayals, intrigues, compromises, arrangements and

settlements in the command structure of the Military which resulted in

Ojukwu refusing to serve under a junior officer.)

The Willink's Report of 1958 succinctly declared that we are a group of

independent and autonomous kingdoms and peoples, with separate languages,

culture and religion, equal in status and in no way subordinate to one

another but united as a corporate body to form the Federal Republic of

Nigeria.

During his electioneering campaigns, President Olusegun Obasanjo assured all

the aggrieved and marginalised people that as soon as he assumed office, he

would redress all the injustices that have for years occasioned the polity

as a result of long period of military mis-rule. A glaring case of this is

the Niger-Delta. Obasanjo gave the people his words. And they were taken as

sacrosanct. A promised sense of belonging in place of lost and despairs. Of

course, these promises were made against the background of the obvious

sustained neglect and abandonment by successive regimes including the

multi-national oil companies engaged in exploration activities and the

consequent declining security situation in the Niger-Delta and its

implications to the economy.

Apparently worried by this development, the conferees of the 1995

Constitutional conference convoked by the late Head of State, Gen. Sani

Abacha recommended against all the rancours at the conference a sharing

formula of the Federation Account Revenue, that 13 percent instead be set

aside for derivation to assist the development of the oil communities long

pillaged by the Federal Government. The thrust of the recommendation was

succinct - to financially empower the oil communities of the Niger-Delta

Region to tackle headlong the colossal neglect, exploitation and degradation

arising from absence of federal presence and the insignificant spending in

the region. But unfortunately, this was not to be, as General Abacha failed

to implement it.

The golden opportunity came in May 29, 1999 when the 1999 Constitution in

which the 13 percent derivation was enshrined finally became operational at

the assumption of office by President Obasanjo. The swearing-in of the

President equally heralded optimism in the deprived and neglected people of

the Niger Delta as the prospect of the implementations of the 13 percent

derivation engendered relief that the once hostile and indifferent nation

was suddenly waking up to the unwholesome, sordid injustice wrought against

them for decades. They believed that the nation was now alive to the grim

reality of a people with long bruised psyches.

But contrary to all expectations this has not come to be. While the

President faces the onerous task of governance, the problems and the issue

of the degradation of the oil producing communities of the Niger-Delta has

receded to the background despite the vandalisation of old pipe lines

constructed in 1976 which are awaiting renewal. The President has my

sympathy but not withstanding this therefore, he should brace up and accept

the challenge which destiny has bestowed on him and should not hide in the

mask of the Supreme Court which will do no one any good.

And to some finer issues: Who owns the land? In many of the oil communities

in the Niger- Delta, the activities of exploration and exploitation have

killed fishes, and destroyed the ecosystem. Who bears the pains of

exploitation? Is it only the Federal, the State Government, the

multinational or the communities that are directly affected? So on what

basis is the federal government appropriating 40% of the 13 percent

derivation revenue? The continental shelf belongs to the ethnic

nationalities adjoining it if Section 3 of the 1999 Constitution is

construed in accordance with the spirit upon which it was framed as the

Federal Government has no land except the Federal Capital Territory.

The Land Use Act of 1978 does not vest the land on the Federal, State and

indeed the Local Government. Section 3 of the 1999 Constitution recognises

36 States and the Federal Capital Territory. There is nowhere the Federal

Government is said to own the land. In States, land is vested on Governors

to hold in trust for the people and in local government, to the chairman and

the Traditional Rulers, also to hold in trust for the people. But when the

land is occupied before the Decree came into effect, the land is vested on

the owners because they have the statutory right of occupancy. The case of

Ojema vs Momodu was an eye opener. That is the structure before the

Constitution. The citizens of these communities were in existence there

before the coming into being of the country called Nigeria.

And talking about the Constitution, there is nowhere it says that the

revenue accruing from derivation should go to the State, but to the

communities which sustained losses through the evils of oil extraction. And

so, why are the States getting all the money and not the immediate

communities from which the oil/revenue is derived? It is common knowledge

that many oil bearing communities complain of the diversion of funds meant

for projects in their areas to some other issues. As a matter of fact,

there is nowhere in the Constitution where it is stated that the 13% should

be paid to the State Government. The money is "rent" for the land hired

from the communities to the oil companies. They need the money for their

pains, their sufferings and as a result of the destruction of their means of

livelihood, and their environment through ecological disasters. The money

ought to be deposited in a Trust Fund that would underwrite their education,

and economic development, each according to its value and contributions.

It is therefore necessary that whenever funds emanate from derivation, it

should be placed in a Trust Fund to be administered by representatives of

all the stakeholders; the communities, the Federal, States, Local

Governments and the multinationals. Such a Board of trustees should

administer all funds for the implementation of projects.

No meaningful social, political and economic progress would be made unless

we restructure and devolve in all its ramifications.

It is Midnight Nigeria. The House is Falling and unless all the parties

come together in a round-table and find a lasting solution to its

intractable problems, Nigeria will always be at war, not of the spirit, not

of the body, but of the soul.

RETURN

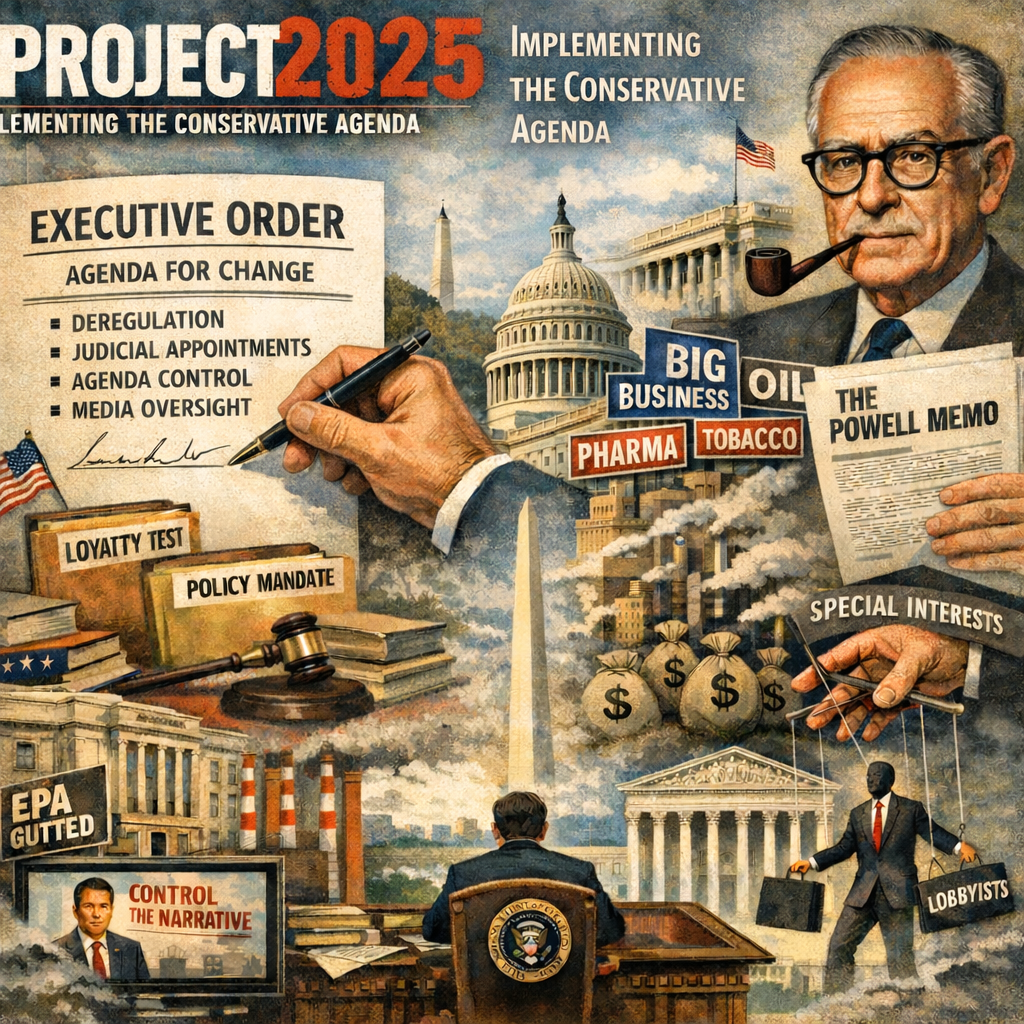

From the Powell Memo to Project 2025: How a 1971 Corporate Strategy Became a Global Template for Power In August 1971, a corporate lawyer named L...

The Market’s Mood Ring: How Volatility Across Assets Traces a Hidden Geometry of SentimentIf you want a fast, honest way to describe modern markets,...

Nigeria’s grid collapses are not ‘bad luck’ – They are a design failure, and we know how to fix themFirst published in VANGUARD on February 3,...

Islands of Credibility: Nigeria’s Best Reform Strategy Starts in the StatesFirst published in VANGUARD on January 31, 2026 https://www.vanguard...

Project 2025 Agenda and Healthcare in NigeriaThe US and Nigeria signed a five-year $5.1B Memorandum of Understanding (MoU) on December 19, 2025, to bo...