• Revenue Commission exposes monumental scandal in Excess Crude Account

• Presidency unilaterally blows $12.79billion

• Confusion over another N196.25billion

• The debt forgiveness connection

culled from THE SUN, Saturday April 22, 2006

How did the the presidency unilaterally withdraw, and spend, over $12.79 billion from Nigeria’s external excess crude account without recourse to the other two tiers of government? What were the huge unexplained sums, totalling over a billion dollars, withdrawn from the same account, between October and December 2005, by the Central Bank, used for? How did the NNPC gain access to the domestic excess crude account of almost N200 billion?

These are questions agitating the minds of some of Nigeria’s financial managers as the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) opens a can of worms on the monumental scandals, sharp practices and abuses that have characterised the management of the controversial Excess Crude Accounts maintained both locally and overseas by the Obasanjo administration.

The revelations form the crux of a report submitted to the RMAFC by its Subcommittee on the Management of Excess Crude Account.

According to the agency’s report, the excess crude accounts may have become the cash pot of a few favoured government officials who now withdraw from them at their individual convenience, without recourse to other relevant arms of government and stakeholders to the accounts.

The report observed that the accounts have so far been run like the private account of the presidency with withdrawals made for even some of those obligations that should directly be met with the federal government’s statutory allocation from the federation account.

With the states and local governments always in the dark as to the exact amount in the accounts – both the foreign accont and the domestic account kept in Naira – the federal government and its agencies and officials are said to have liberally helped themselves – determining the inflow, deciding the outflow and also working the books themselves.

The result is that the federal government unilaterally stopped the sharing of the excess crude revenue, telling the other stake holders that it had already spent over $12 billion of their money to pay Paris Club. This is in addition to the fact that the same federal government and its NNPC have failed to give the other stakeholders, and the nation, a clear picture of the domestic account and had made other sundry payments and commitments, allegedly on their behalf without as much as first asking them – even as they have no immediate means of independently cross-checking and verifying the claims.

However, the RMAFC, an agency of the Federal Government, had been compelled to investigate the accounts following the deadlocked meeting of the Federation Account Allocation Committee (FAAC) on January 17, 2006 where the states and their governors refused to accept any payment from the federation account. The refusal, Saturday Sun gathered, was as result of the “withholding of substantial amounts from the Domestic Crude Proceeds due to the federation account by the NNPC”.

The FAAC, as a result, had attempted to pay the states a lot less than they were expected to get. The states, collectively rejected their allocations and a deadlock ensued. It was in order to find a solution that would resolve the deadlock and ensure that such a problem does not occur again that the RMAFC organised the retreat on the federation account and other related matters.

The retreat held between Monday, February 13 and Sunday, February 19, 2006 and the shocking revelations of flagrant abuse were contained in the report of the Sub Committee on the Management of Excess Crude Account.

Paris Club, debt forgiveness fraud

The report also frowned at the way and manner the presidency unilaterally drew down over $12 billion from the overseas account to pay to the Paris Club in the still very controversial debt forgiveness deal.

It said that apart from not seeking the consent of the states and the local government, the federal government pulled the money from the collective account to settle a debt which was not collectively procurred.

According to the report, over 80% of the said debt belonged to the Federal Government while the other 20 was owed by the states. Even at that, staes like Nasarawa, Katsina and Kaduna were not owing Paris Club a dime. The same goes for all the local governments. The RMAFC, therefore, noted that it was unfair and a disregard of the concept of fiscal federalism to force those states and the local governments to repay what they did not owe.

It said this was only possible, however, because the federal government usually operates the Excess Crude Account to the disadvantage of the other tiers of government. The report noted that as at the time Obasanjo refused to pay the other tiers of government, on the ground that the money had been used to settle Paris Club, the amount due to be shared from the excess crude earnings was $12,510,838,669.75.

Given the operational sharing formular of 52.68% to the federal government, 26.72% to the states and 20.60% to the local government, it meant the councils were unilaterally robbed of over $2.5billion.

It noted: “The share of the local governments from the excess crude account should have been excluded from the debt payment for the obvious reason that they contracted no external debt.The federal government which owed 83% of the loan ought to have contributed $10.383billion while the 33 debtor states should have contributed $2.016billion of their respective shares from the excess crude account to make up the $12.4billion arrears required to be paid”.

However, the report noted that “this simple equity principle ‘from each according to his burden’ was not followed, hence the lump sum payment which included share of local governments and some states such as Nasarawa, Katsina and Kaduna that were not owing the Paris Club”.

CBN withdrawals

While not alleging any fraud on the part of the Central Bank of Nigeria (CBN) in the Excess Crude Account mess, the committee noted that there was no explanation as to what the CBN used the huge amounts it withdrew from the foreign account for.

Most of the withdrawals, totalling $1,169,364,481.86 and made between October 2005 and December 2005, were not accompanied by any explanatory notes.

There was one huge withdrawal of $846,554,061.00 in October 2005 and then five other withdrawals later.

In the same 2005, the federal government had withdrawn over $98billion as first instalment payment for the funding of the Niger Delta Holding Company Plants. Another $77.8billion was soon withdrawn as second instalment payment for the plants. Then there was the $12.4 billion withdrawn to pay the Paris Club external creditors.

The Niger Delta Holding Company Plants soon appeared on the list again with a further $664,771.18 and finally another $609,145.25 million. Between those two withdrawals, there was a $213,230,000.00 withdrawn for the NNPC Joint Venture Operation –Gas for NDDC Plants.

All the withdrawals were made without consulting any of the other stakeholders to the Excess Crude Accounts.

Conflicting figures

Of all the questionable deals surrounding the Excess Crude Accounts, the report noted that the most disheartening is the inability to establish, with some degree of certainty, the exact amout in the Domestic account.

While it was able to establish that the Excess Crude Foreign Account, as at January 2006, stood at N5.325 billion, it noted that the about N196.25 billion recorded for the domestic account could not be relied upon.

“It is of interest to note that according to FAAC January, 2006 a sum of N196.25 billion was stated to be in the domestic excess account. However, during the recent Senate hearing, there were discrepancies among the figures from NNPC, CBN and the Federal Ministry of Finance”, the report said.

Much of the confusion was attributed to the practice of giving the NNPC access to the said account, even though the corporation, as a revenue contributor should rather be monitored over the account and not the other way round.

Illegality

While noting that it was not out of place for a government that makes extra-budgetary revenue to put something aside for the rainy day, the report urged government to work with the National Assembly to make a law that would give legal backing to the practice. For, as it stands today, there is no legal framework to support the setting up of an excess crude account, as the constitution states that all revenues earned by the country – except a few stated exemptions – must be paid into the federation account.

It further noted that this lack of legal backing has seen the presidency doing as it likes with the accounts and the funds therein. For instance, it pointed out, “The federal government has taken it upon itself to be the sole custodian of the excess crude account. It also imposes directives on the use of the account. The executive directive to share only 50% of the 2004 excess crude proceeds and nothing for 2005 was most arbitrary. The directive not to distribute anything from the excess proceeds account in 2006 was most unfortunate”.

The RMAFC subcommittee which re-emphasized the developmental drawbacks of refusing to pay the other tiers of government their due from the excess crude account was chaired by Alhaji Yakubu Shehu and had other members as Mr. Sam Nnebe-Agumadu (Vice Chairman), Otunba Oladeji Ariyi (member), Maj. Gen. O.E. Obada rtd (member) and Abdullahi S. Maiunguwa (secretary).

Genesis of excess crude account

The Excess Crude Account concept which was revived in 2003 by the Obasanjo administration followed in the path of the dedicated account which the Gen. Ibrahim Babangida administration opened to accommodate the excess oil revenue that came as a result of the first Gulf War – earnings that would later be dubbed ‘oil windfall’.

With oil prices soaring to all-time high since the coming of the Obasanjo administration, the differentials between projected revenue in the annual budgets and the actual revenue necessitated by ever-rising global oil prices has seen the country’s earnings nearly doubling at the end of every budget year. This year for instance, while the budget was based on a $33-per-barrel estimation, the barrel of Nigeria’s type of crude sold for $60 for most of the year and has now nodged beyond the $70 mark.

The excess crude account is therefore a way of mopping up excess liquidity and checking inflation.

The account is operated in two parts. While one, domiciled overseas, recieves payments in excess of budgeted benchmark for barrel of oil sold, excess PPT (any amount above the budgeted monthly revenue target of $394920,000) as well as excess royalties (any amount in excess of the budgeted monthly revenue target of $180,610,000), the account domiciled in Nigeria is the one into which excess revenue derived from sales of crude oil to NNPC for local production is paid.

“In 2003 alone, for instance, a total of $1.07935 billion was realised, out of which $0.8569 billion was deducted. By 2004, the amount realised as excess revenue had jumped to $6.07083 billion with $0.1519 deducted and a further 50% of the balance was shared to the beneficiaries in 2005. In the same vein, a total sum of $18.232 billion was realised in 2005 out of which $12.907 billion was deducted, leaving a balance of $5.325 billion as at January 2006”.

RETURN

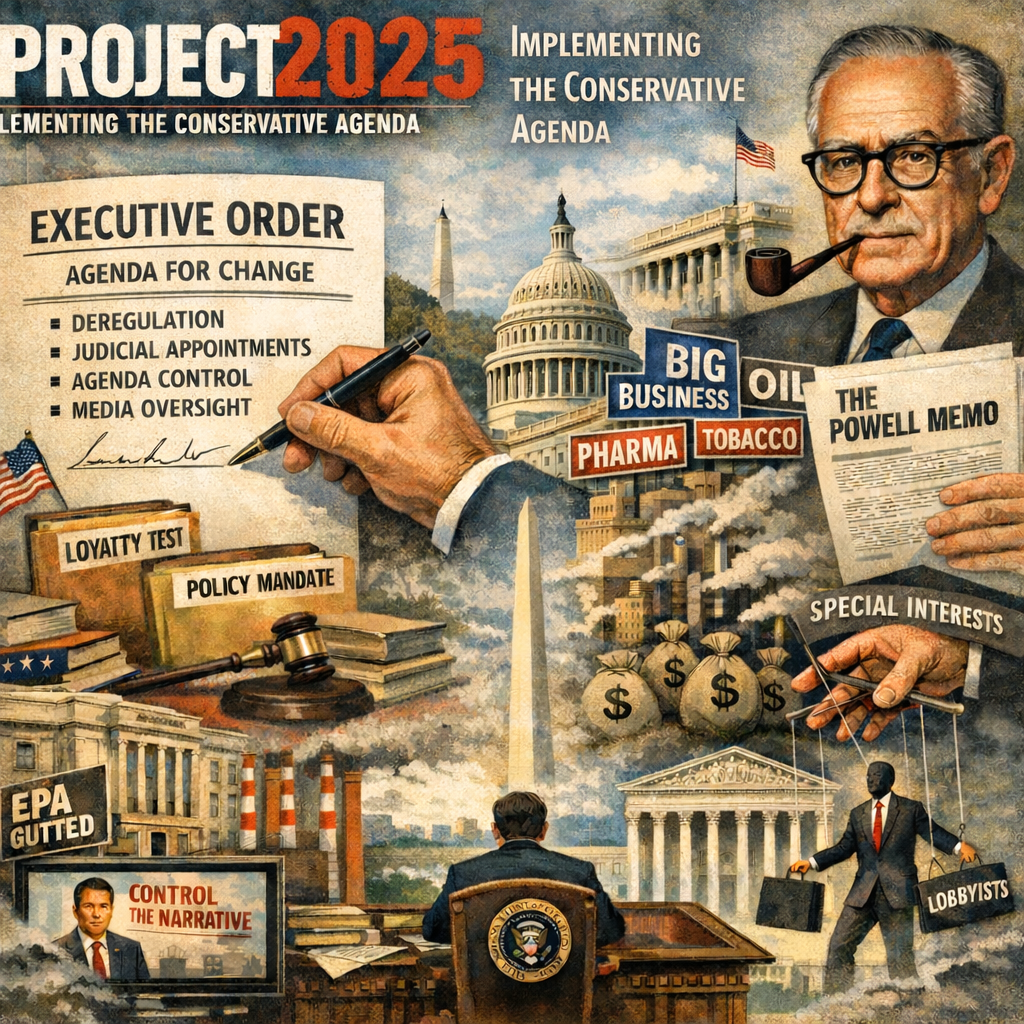

From the Powell Memo to Project 2025: How a 1971 Corporate Strategy Became a Global Template for Power In August 1971, a corporate lawyer named L...

The Market’s Mood Ring: How Volatility Across Assets Traces a Hidden Geometry of SentimentIf you want a fast, honest way to describe modern markets,...

Nigeria’s grid collapses are not ‘bad luck’ – They are a design failure, and we know how to fix themFirst published in VANGUARD on February 3,...

Islands of Credibility: Nigeria’s Best Reform Strategy Starts in the StatesFirst published in VANGUARD on January 31, 2026 https://www.vanguard...

Project 2025 Agenda and Healthcare in NigeriaThe US and Nigeria signed a five-year $5.1B Memorandum of Understanding (MoU) on December 19, 2025, to bo...