Testimony by Mobolaji E. Aluko, PhD, President, Nigerian Democratic Movement (NDM) [Professor & Chair of Chemical Engineering, Howard University] Before the US Congressional Subcommittee on Domestic and International Monetary Policy, Committee on Banking and Financial Services

May 25, 2000

Introduction

Mr. Chairman, Honorable Members of Congress on the Subcommittee on Domestic and International Monetary Policy of the Committee on Banking and Financial Services, ladies and gentlemen:

It gives me great pleasure and it is a privilege to testify before you today on ways in which the United States and its other partners in the international community might be able to assist Nigeria in creating sustainable economic growth after so many wasted years under tyrannical and unprogressive military rule. Due to the short time that I have, I will be direct and state that those ways include as foremost (i) debt relief, including outright cancellation; (ii) loot recovery from Western banks and (iii) constitutional reform.

Debt Relief

During the period 1986 to this year 2000, the exchange rate between the US dollar and the Nigerian Naira changed from US$ 1 equals about 2 Naira to $1 = 100 N. Furthermore, its internal debt increased from N36.5 billion in 1986 ($0.36 billion in today's dollars) to about N400 billion ($4 billion) today.

During this same period, Nigeria's external debt increased from $11.5 billion in 1986 to $33.2 billion in 1990, $33.4 billion in 1991 and then fell to $29.5 billion in 1994. It rose to $32.6 billion in 1995. Currently, it is placed at about $30 billion dollars, or about 70% of its 1999 estimated Gross Domestic Product, and of which about $14 billion is payment on arrears. During this period it has, at an official level, tried everything to manage the debt: debt rescheduling, debt conversion, debt-buy back and curtailed new borrowing, yet it has seen little or no relief. The strategy is just not working and cannot work.

For the US, the dollar figures quoted above are not large, but for Nigeria, they are insurmountable, but go to accentuate the fact that Nigeria with its monoculture of oil and its 120 million population, is a poor country, even though it is oil-rich. In fact, the current 2000 National budget of Nigeria which the Executive and the legislature are still haggling over is roughly N600 billion ( roughly $6 billion), which is what the District of Columbia is budgeting to spend on its schools in the coming year. But this Year 2000 budget means that 120 million Nigerians will have to starve for about 5 years if it is to use up all of its money to pay off its external debt if all interest payments were to be frozen today.

What all of this means is that if Nigeria is to EVER hope to reap any "economic dividend" which President Obasanjo so much harps upon and improve the lives of its citizens, it is imperative that Nigeria be granted a mixture of :

(i) IMMEDIATE stoppage on interest payments; (ii) OUTRIGHT cancellation of a substantial portion of its debt; and (iii) An institutional RE-DIRECTION of some portion of the debt under international supervision to definite projects such as health (AIDS and malaria), water provision and education within the country.

In general, these tally with the Jubilee 2000 recommendations for the cancellation of debts of developing countries which are commended to this sub-committee, with some modifications depending on each country.

As a keeper of my African brothers and sisters, I should not, must not talk just about Nigeria alone without talking more generally about Africa's debt burden as a whole owed by its governments to multilateral, bilateral and commercial donors, which currently stands at about $350 billion. Of the 41 nations identified by the World Bank as Heavily Indebted Poor Countries (HIPC), 33 are in Africa. The Cologne meeting of the G-7 promised relief, and in 1999 the U.S. is to be commended for taking the first steps to meet its obligations. However, the United States must exercise greater political will and a serious commitment to find the funds to make deep debt relief a reality, and must appropriate, not just authorize, to raise the current level of funding in the foreign operations bill from a paltry $75 million to the needed $435 million for this year. The fact of the matter is that if the United States government contributes its fair share to the international debt plan, and you and your colleagues approve $810 million over the next 3 years, this will encourage all creditors to do their part, and $90 billion in debt can be written off for 33 of the world's poorest countries. This is because due to US's leadership, every dollar that you contribute to the HIPC trust fund will leverage more than $20 dollars from other international creditors and regional development banks. More than 17 countries have already made a contribution and several others have made pledges to the trust fund contingent on the U.S. contribution. They are waiting for your action!

Loot Recovery

I am sure that at the back of the mind of everybody listening are the questions: how did Nigeria incur these debts in the first instance, and what has the country got in return? How can we ensure that debt relief will not result into more bad behavior, if that was what cause all the debt in the first instance?

Despite all of the debt, Nigeria remains an under-developed country with very weak physical infrastructure and an outrageously low human development index. Although a lot of money was spent on education, particularly in mid-70s to early 80s, much of the money owed was spent on conspicuous consumption and unproductive salary increases in the public sector. However, more outrageously, for the overwhelming portion of the debt, it is estimated that over the years US $98.8 billion is stashed away by Nigerians in foreign banks, illegally acquired money by its leaders, family members and cronies. During the Gulf Crisis of the early 90s, about $12 billion of Nigeria's oil windfall went missing. In five years alone (1993-1998) General Abacha and some members of his family are now confirmed to have salted away as much as $5 billion in Swiss, German, UK and American banks, among several other countries. Abacha's son, currently on trial in Nigeria for other suspected crimes, recently confessed to moving $700 million in cash from his home in Abuja through several such banks, all on behalf of his father, no questions asked.

It is mind-boggling. One wonders how these large sums of monies from developing countries are moved between banks in Western countries without eyebrows being raised, when within the US, for example, a bank has to report to the US Reserve Bank if more than $9,999 is transferred from a single account!

However, not all the loot was acquired by Nigerians alone. Some of the schemes ostensibly used to reduce the debt, particularly the debt-buy-back schemes, were in fact avenues for loot acquisition both by Western individuals and banks in the West. In this respect, my organization the NDM has recently passed onto the US State Department and the Internal Revenue Service a thick document of dubious-looking schemes from 1988 to 1993, involving US individuals and some otherwise reputable banks involving as much as $6 billion dollars of Nigerian bought-back debt - in promissory notes, government debts and multilateral debts. This is detailed in the so-called "Fashanu Report" after a UK-based Nigerian ex-soccer star named John Fashanu who has taken it upon himself to expose some of the suspected funny financial criminality and international sharp practices, and who has also been in touch with British and Swiss government officials with the same document. One does not know exactly how much of these monies in the Fashanu Report were looted or laundered, but a close investigation of the deal files might reveal the extent.

The Obasanjo civilian regime has made an anti-corruption crusade one of its watchwords, and it must be encouraged by the United States in that direction. It has, (together with the Abubakar military regime before him) already reported recovery or freezing of some of the loot (as much as $2 billion total so far), especially from and in Swiss banks, some directly from the Nigerian crooks and their partners, but there is greater need of multilateral cooperation with Nigeria and relaxation of secrecy laws to speed these recoveries. None has been reported from the US so far, but there must be some bodies buried here as noted above.

If we can recover a substantial part of this loot, it can be used to pay back some of our excruciating external debt. A multilateral approach is clearly needed, because in this digital age, money is readily transferred across capitals with the click of a mouse. If we can plug the complicity of Western individuals and banks in the raping of developing countries such as Nigeria, maybe the continent of Africa will not be described as "hopeless" according to the recent alarmist characterization by The Economist magazine.

Constitutional Reform

Nothing in the economic realm happens properly outside the law, and the source, the well-spring of that law is the constitution of the country.

During the years of military rule in Nigeria, government was run by decree, by fiat. The various military governments suspended various portions of the most recent constitution, and even those unsuspended portions were followed only capriciously and in the breech. For years, we had the oxymoron: "Federal Military Government of Nigeria." Each time the military transited out of governance, we were left with a new Constitution with a heavy stamp: "Made in the Barracks" without citizens' ownership as can be obtained for example from a referendum.

Since May 29, 1999, Nigeria now once again runs a Civilian Federal System of governance with separation of powers between the Executive, the Legislature and the Judiciary similar to that of the United States. However, that is where the similarity ends. Whereas in the United States, the original states sat together to form a union, and more states were later formed as part of the union as additional territory was acquired and populations grew, Nigeria's colonial legacy coupled with decades of military rule has provided the country with an inverted false Federalism which is difficult to manage, and which has become ossified in the most recent 1999 Constitution. Parties are sanctioned by the state, not through free association. Without ideological differences between the parties, the electorate is left to choose, if at all, between personalities, who then go on to cut private deals in parliament. The quickest form of punishment in parliament for any infraction now seems to be impeachment or threat of such, and there is a fundamental confusion in the minds of the legislature as to their role in law-making and executive functions. Consultation by the Executive of the legislature for advice and consent is perceived to be a necessary nuisance. The Federal might is suffocative of state rights, which in turn are suffocative of local government rights. There is too much power and too much money in the centre to the detriment of the states where the money is derived. The weak physical and financial infrastructure makes it virtually impossible to run such a relatively big country from some central command, a familiar structure inherited from years of military rule.

The constitutional requirement that will enable changes to occur is onerous: 2/3 of the National Assembly and 2/3 of the State Assemblies. In a country still riven with ethnic, religious and socio-economic divisions, it is most unlikely changes that are necessary NOW will come any time soon. Both the Executive and the Legislature recognize the need for constitutional reform - each has been a victim in one way or the other of the present 1999 Constitution, and are "learning" it as they go along - but are pursuing parallel paths in engaging the nation in this important task.

Demands for a national conference of nationalities and civil society of some sort for settling of the National question as well as a comprehensive root-and-branches reform of the Constitution are loud, but are rather hastily and haughtily dismissed by the Executive and legislative leadership - who feel threatened by such a device - as recipes for disintegration of the country. One fears that by the time it is recognized that a sovereign national conference - my preferred option and recommendation to this body for consideration - is absolutely necessary, that time might be too late.

The US and the international community has the obligation to nudge all parties to a dialogue, so that UN hard-hats do not find their way to Nigeria some day. As Nigeria goes, so goes West Africa. ...

RETURN

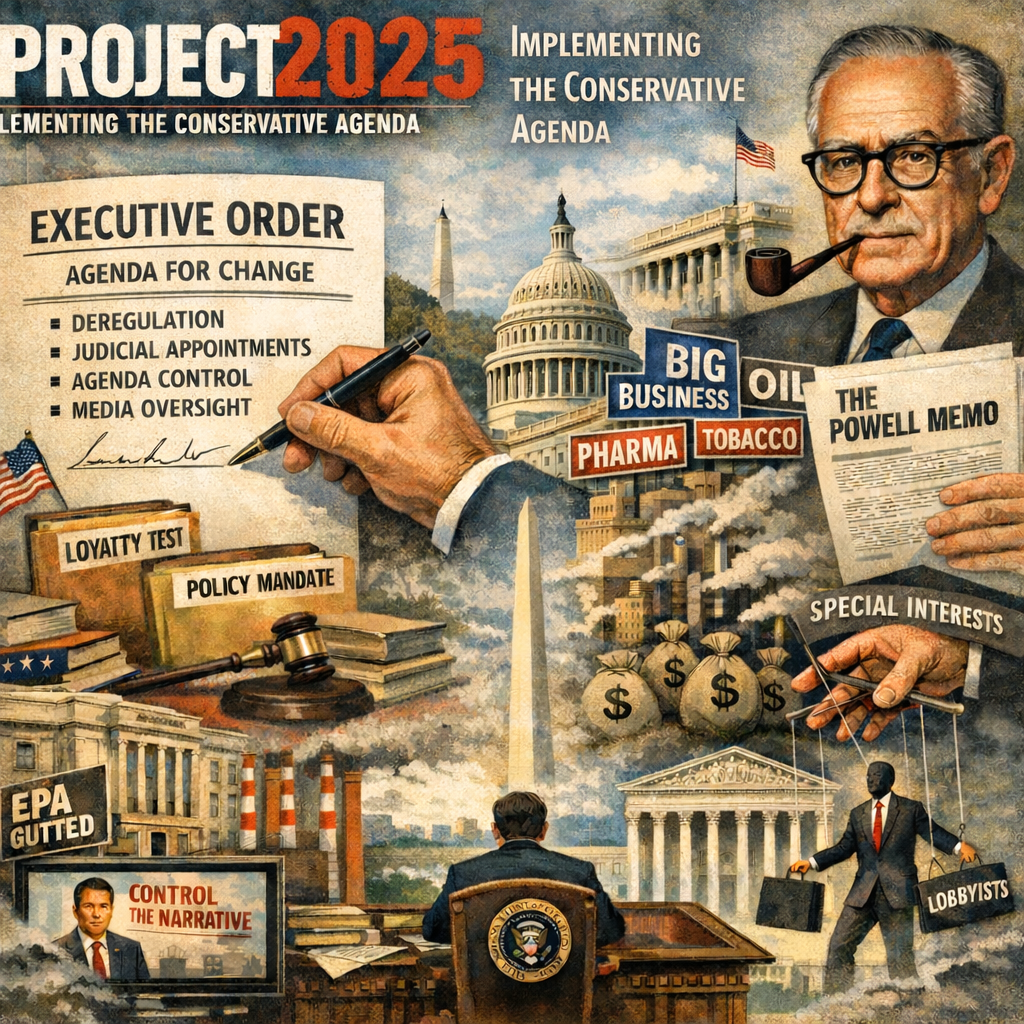

From the Powell Memo to Project 2025: How a 1971 Corporate Strategy Became a Global Template for Power In August 1971, a corporate lawyer named L...

The Market’s Mood Ring: How Volatility Across Assets Traces a Hidden Geometry of SentimentIf you want a fast, honest way to describe modern markets,...

Nigeria’s grid collapses are not ‘bad luck’ – They are a design failure, and we know how to fix themFirst published in VANGUARD on February 3,...

Islands of Credibility: Nigeria’s Best Reform Strategy Starts in the StatesFirst published in VANGUARD on January 31, 2026 https://www.vanguard...

Project 2025 Agenda and Healthcare in NigeriaThe US and Nigeria signed a five-year $5.1B Memorandum of Understanding (MoU) on December 19, 2025, to bo...